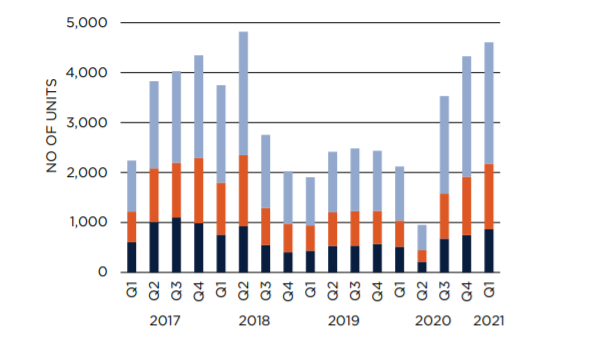

Chart of the Day: Private units sold in secondary market jump 6.5% in Q1

Due to construction delays, buyers may prefer "ready-to-move-in" properties.

This chart from Savills Singapore shows that the number of private residential units sold in the secondary market jumped 6.5% QoQ to 4,607 units in Q1 2021.

Due to uncertainties of construction delays, buyers may prefer properties that are in “ready-to-move-in” condition, the report said. Also, the significant price gap between new and resale properties may have customers to consider resale properties instead.

The transaction volume in the resale market across all three market segments registered QoQ growth, with the largest increase of 16% coming from the core central region (CCR) with 865 units transacted.

This was followed by a 12.3% growth in the rest of the central region (RCR) with 1,312 units transacted and a 0.7% increase in the outside central region (OCR) with 2,430 units transacted.

Advertise

Advertise