HDB resale prices down 0.2% in July

The new CPF rule has caused has dragged on the asking prices for older flats in mature estates.

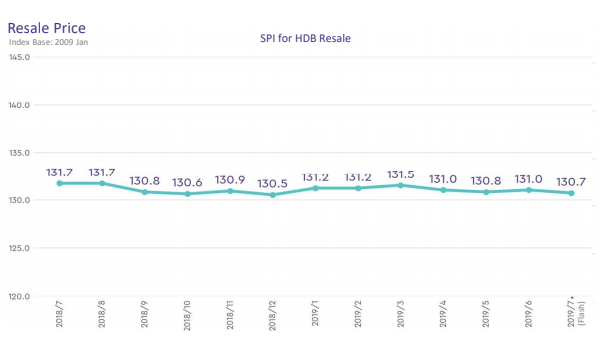

HDB resale prices fell 0.2% in July from June, SRX Property Research revealed. On a YoY basis, prices were down 0.8%.

Prices of HDB Executives also rose 0.3%, whilst prices of three- and five-room flats fell by 0.9% and 0.1% respectively. On the other hand, four-room flat prices remained flat for the month.

Non-Mature Estates prices grew 0.2%, whilst Mature Estates prices fell 0.8%. On a YoY basis, Non-Mature Estates prices rose 0.1% whilst Mature Estates prices grew 1.9%.

Christine Sun, head of Research & Consultancy at OrangeTee & Tie, commented, “The price fall for flats in mature estates can be attributed to the higher proportion of older flats that may have dropped their asking price due to the increasing supply of newer flats that have reached Minimum Occupation Period (MOP) in non-mature estates. Shorter waiting time for BTO flats and ongoing supply from BTO launches have likely drawn some potential buyers away from the resale market.”

There were 2,120 HDB resale transactions on July 2019, up11.9% increase from June. Resale volume in July is 17% lower than the previous year. However, compared to the average volume in July from the last five years (2014 to 2018), July 2019 is 19.7% higher.

Sun noted that the demand for resale flats especially older units may have increased after the recent CPF rule changes that allow buyers to use more of their CPF savings as well as get bigger HDB loans for older flats, as long as the property's remaining lease covers the youngest buyer until the age of 95.

Also read: Chart of the Day: New CPF loan rules boost demand for older flats in May-June

“We have also observed an increase in newer flats being put up for resale recently as many of these flats have reached their five-year MOP and are eligible for resale,” she said.

The highest transacted price for a resale flat in July 2019 is at City View @ Boon Keng, where a high-floor 5 Room unit is sold for $1.21m. In Non-Mature Estates, the highest transacted price is an Executive unit at Hougang transacted at $908,000.

Overall median Transaction Over X-Value (T-O-X) is NEGATIVE $1,000 in July 2019.

Only HDB 3 Rooms registered a POSITIVE median T-O-X of $2,000 in July 2019, whilst HDB 4 Room, 5 Room and Executive recorded NEGATIVE median T-O-X of $1,000, $1,000 and $7,000 respectively.

Kallang/Whampoa posted the highest median T-O-X at POSITIVE $9,000 in July 2019, followed by Choa Chu Kang at POSITIVE $6,000. Serangoon posted the lowest median T-O-X at NEGATIVE $13,000, followed by Queenstown at NEGATIVE $11,000.

The median T-O-X for HDB measures whether people are overpaying (POSITIVE T-O-X) or underpaying (NEGATIVE T-O-X) the SRX Property X-Value estimated market value.

An estimated 680 flats will potentially enter the HDB resale market within the next three months, according to SRX data, as these units approach their respective five-year MOP.

Advertise

Advertise