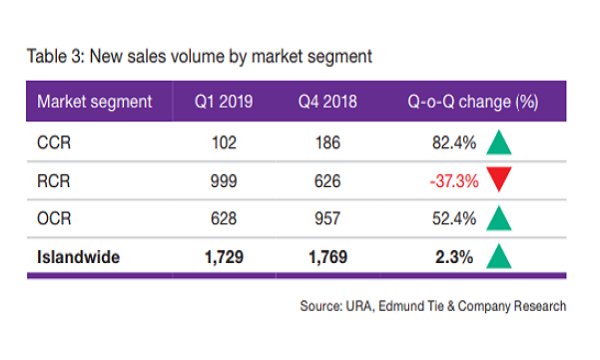

New condo sales volume up 2.3% in Q1

The Core Central Region recorded the largest increase in volume at 82% QoQ.

With a 13.4% increase in the number of project launches and new units launched for sale in Q1 2019, total new condo sales volume edged up 2.3%, Edmund Tie & Company’s (ET&Co) latest housing report revealed.

The largest increase in new sales volume was in the Core Central Region (CCR), jumping more than 82% QoQ, followed by the Outside Central Region (OCR) at 52.4% QoQ. In contrast, new sales volume in the Rest of Central Region (RCR) crashed 37.3% QoQ.

Also read: Luxury home sales take off in Q1

In the CCR, which includes main prime areas including the Central Business District (CBD), the number of units launched in Q1 2019 (337 units) more than doubled those launched in Q4 2018 (153 units), with sell-down rate of 14.3%. ET&Co noted that Boulevard 88, a freehold luxury project in prime District 10, was the best-performing project during the quarter, selling 26 of the 35 units launched in Q1 with prices ranging from $3,300 to $4,900 psf.

Like the CCR, the number of units launched in the OCR during Q1 (796 units) were more than 2.5 times higher compared to Q4 2018 (300 units). However, the sell-down rate fell to about 9.9%, as the scale of the projects launched were much larger such as Treasure at Tampines (2,203 units) and The Florence Residences (1,410 units).

“Buyers in the OCR tend to be more price-sensitive, with Treasure at Tampines as the best-selling project that achieved 59% launched sell-down rate (i.e. selling 289 of 490 units launched) and unit prices ranging from $1,173 to $1,467 psf,” Saleha Yusoff, ET&Co’s executive director and regional head of research and consulting, explained.

Meanwhile, the RCR had the lowest number of new project and unit launches at four and 326, respectively, and hence a lower sell-down rate of 10.1% from Q4 2018’s 21.1%. That said, ET&Co noted that 1953, a mixed-use freehold development in Farrer Park, had the highest sell-down rate of 31%. It sold 18 out of 58 units, with prices ranging from $1,706 to $1,971 psf. However, the firm noted that this was a small project comprising only 58 units.

Also read: Developer sales fell 75.5% to 444 units in April

The report further highlighted that demand for smaller studio to two-bedroom units continued to dominate the new sales market, accounting for 79% of total new sales, although this was down slightly from 80.7% in Q4 2018.

“As such, there was a slight uptick in demand for the larger units (three-bedroom and above), particularly for projects in the CCR,” Yusoff noted.

Despite the property curbs and higher new sales volume, 75% of new sale transactions were priced below $1.5m in Q1 2019, unchanged from Q4 2018 as Singapore citizens (SCs) continued to be price-conscious. ET&Co highlighted that there was a slight increase in units priced from $1.5m to $2m and greater than $3m, which was consistent with the small increase in demand for the larger three-bedroom and above units.

But with the property curbs imposing higher levies on Singapore permanent residents (SPRs) and non-permanent residents (NPRs), condo sales volumes for these two groups declined for the third consecutive quarter by 3.6% and 5.2% QoQ, respectively, in Q1 2019.

Also read: Chart of the Day: Property buyers from Taiwan and Korea grew in Q1

“The proportion of SPRs remained unchanged at around 16%, whilst NPRs decreased 1 percentage point (ppt) to 5% in Q1 2019,” Yusoff said.

Amongst NPRs, ET&Co noted that the main foreign condo buyers were from mainland China (27.4%), Indonesia (9.5%), US (7.8%), India (3.8%) and Malaysia (1.7%).

Advertise

Advertise