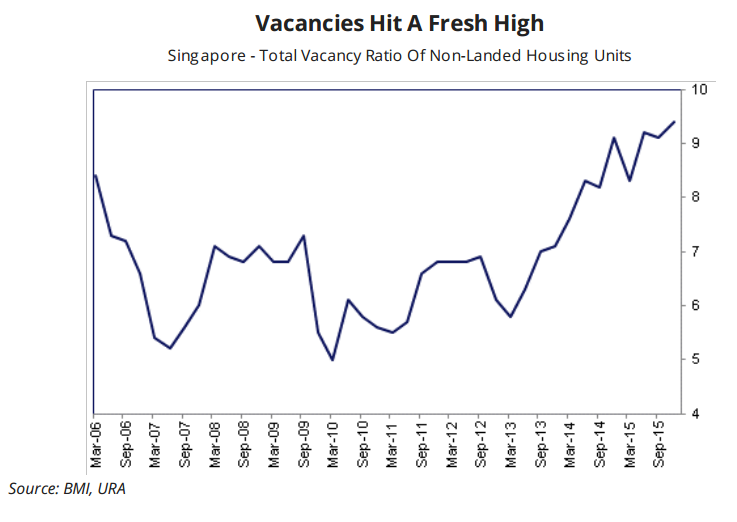

Chart of the Day: Bank lending slows to a crawl as home vacancies hit record high

Loan growth will hover at just 1.5%.

The housing boom once fuelled loan growth in Singapore, but analysts warn that lenders in the city-state will have a tough time peddling mortgages this year as the home vacancy rate hits a record high.

This chart from BMI Research shows that the vacancy rate of non-landed properties rose to 9.4% in the fourth quarter of 2015,, the highest level since at least the first quarter of 2006 when the series was first compiled.

The report warned that this trend is unlikely to be reversed any time soon, and the local home market is headed for another year of price declines in 2016 on back of slow economic growth, lacklustre rental demand and the continued effect of cooling measures.

As a result, loan growth is expected to register at a measly 1.5% this year, BMI Research said.

“Singapore's real estate market is set for another year of price declines in 2016 as a middling macroeconomic outlook, subdued rental demand dynamics, the retention of market cooling measures by the government and central bank, and a gradually tighter credit environment continue to weigh. This outlook will feed into tepid loan growth of just 1.5% for Singaporean banks,” the report noted.

Advertise

Advertise