Commercial Property

OUE C-REIT’s net income dips 14.2% YoY to $93.6m in H1

OUE C-REIT’s net income dips 14.2% YoY to $93.6m in H1

The decline was due to the deconsolidation of OUE Bayfront’s performance.

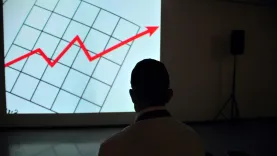

Chart of the day: Residential sector overtakes commercial property in investment sales

Transaction volume of residential property types makes up 45% of the total volumes in Q2.

CICT appoints new members of the board, board committees

The new set of designations will take effect on 25 July.

MNACT’s net profit rises by 4.1% YoY to $81.5m in Q1 FY22/23

The profit growth was largely driven by two factors.

Mapletree Logistics Trust DPU up 5% YoY in Q1

The distribution per unit rose to 2.268 cents.

Property investment sales to grow by 15% to 20% for whole of 2022

This despite a 36.9% decline in sales value in Q2.

Rising interest rates cut by half acquisitions by S-REITs: analyst

In H1, SREITs posted a total acquisition value of $3.6b.

MCT, MNACT merger to make way for larger acquisitions, projects: analyst

The merger was effective on 21 July 2022.

Retail property market to see broad-based recovery after Q2

For the entire year, prime retail rents is expected to grow by 2% to 4%.

The destination office marks the new return to work normal

Cushman & Wakefield’s new 11,400-sqft office exudes the same vibe as Singapore’s best bars.

CBD, Grade A office rents grew 1.8% QoQ in Q2

Rents were at $11.10 per square feet in the second quarter of 2022.

Real estate investment sales volume hits $19.1b in H122

This is already equivalent to more than 70% of 2021's total sales volume.

Grade A office rents to grow around 3%-5% for 2022

Return-to-office momentum to drive higher demand for offices.

Grade A Core CBD office rents mark fastest pace of increase since 2021

Rental growth accelerated from 1.4% QoQ in Q1 22 to 3.2% QoQ in Q2 22.

Singapore “safe haven” reputation to prop up prime grade office rents

Full-year office rent growth will come between 3% up to 5%.

CapitaLand Development buys prime mixed-use site in Vietnam

It is expected to be launched in 2024 and be completed in 2027.

Sinarmas Land Limited to dispose of Horseferry Property Limited for $415.1m

It will be sold to LTH Property Holdings 3 Limited.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform