UOB

UOB is a bank in Asia that provides a wide range of financial services such as personal financial services, private banking, business banking, commercial and corporate banking, transaction banking, investment banking, corporate finance, capital market activities, treasury services, brokerage and clearing services, asset management, venture capital management and insurance.

See below for the Latest UOB News, Analysis, Profit Results, Share Price Information, and Commentary.

Analysts suggest more policy tightening to keep inflation in check

RHB and UOB said this is a precautionary measure if core inflation accelerates.

Analysts suggest more policy tightening to keep inflation in check

RHB and UOB said this is a precautionary measure if core inflation accelerates.

Singapore banks to report flattish Q4 22 earnings amidst slow global growth

NIMs will rise but the expansion could decelerate due to higher funding costs.

Daily Markets Briefing: STI declines 0.31%; CapitaLand Investment is most active stock

CapitaLand Investment increased by 1.58%.

UOB to issue S$850m perpetual capital securities with 5.25% rate per annum

The distribution rate will reset on 19 January 2028 and every five years thereafter.

Gradual easing of inflation to stabilise S-Reits: analyst

Inflation slowly eased in October and November 2022.

AI, big data amongst trends in banks: Maybank

Investments in AI are at an accelerating pace for DBS, UOB, and OCBC.

Banks in the Lion City have been deploying AI and big data at an accelerating pace, analysts from Maybank said.

Amongst the banks that are investing in these technologies are DBS, OCBC, and UOB.

For instance, DBS allocated $1b annually for the past four years. In fact, the bank sent out 30 million personalised insights to 3.5 million customers.

Another bank investing in such tech is UOB, which sought to spend $500m to scale digital offerings until 2026, on top of the average $535m spent on technology yearly in the past four years.

OCBC also made its technological investments such as the AI lab it already launched in 2019.

“These investments are now reaching commerciality, enabling the banks to leverage customer data and relationship-driven insights,” read the report.

What these advancements are doing is to allow banks to leverage customer data as well as relationship-driven insights.

For example, in retail banking, it is initially translating into serving up personalised product offerings including discounts and targeted deals.

The advanced tech also offers customised insights on customer spending habits and automated assistance on payments and subscriptions are becoming standard offerings on their digital apps.

Daily Markets Briefing: STI up 0.22%; CICT is most active stock

CapitaLand Integrated Commercial Trust was the top stock with a 4.75% growth.

Analyst sees banking ROE improvement due to NIM expansion

RHB said there will be tailwinds from hikes in federal funds rate.

SIA, UMS Holdings amongst top stocks in November: UOBKayHian

The broker said the two stocks are expected to post robust revenue growth.

End-year festive demand to keep uplifting retail sales: UOB

Big ticket item transactions are expected in the remaining months of 2022.

Singapore economy to grow ‘markedly slower’ in 2023: report

UOB forecasts a 0.7% GDP growth rate.

UOB transforms HR services with Workday’s Human Capital Management

Enhanced data analytics enables UOB to make improved real-time HR decisions.

Top 100 stocks booked $712m of net fund inflow in November

Banks, consumer cyclicals, and telco sectors led the fund inflow.

Perennial Holdings clinches S$3b green loan for 8 Shenton Way redevelopment

It is the world’s largest real estate green loan in Asia to date.

Interest rates will be Singapore banks’ boon and bane through 2023: analyst

It’ll benefit them over the next three quarters, but asset quality may deteriorate after.

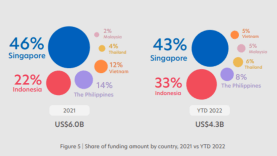

Chart of the Day: Singapore secures highest FinTech funding in ASEAN

Total FinTech funding in Singapore YTD reached $1.8b.

Daily Markets Briefing: STI up 1.57%; Keppel Corp on top

Keppel Corp led the index with 4.66% gains.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?