Financial Services

MAS defers digital bank licence review to H2 2020

MAS defers digital bank licence review to H2 2020

It had earlier planned to announce the successful applicants in June.

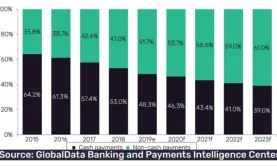

Chart of the Day: Pandemic spurs digital payment take-up in Singapore

Electronic payments are expected to take up 61% of transactions by 2023.

MAS floats $125m support package for financial firms, fintechs

It will support workforce training, operations and access to digital tools.

UOB to shut down 24 branches

Thirty-eight will remain open, each located within a 3km radius from a closed branch.

MAS alters regulatory requirements for COVID-hit banks

Banks can now adjust their capital buffers to support lending activities.

DBS to start closing branches until 4 May

Its Treasures and Treasures Private Client centres will also shut down.

Insurance services to remain open

The government has raised distancing measures against COVID-19.

MAS names new assistant managing director

Celine Sia will hold the position for economics and knowledge management.

Maybank Singapore temporarily shutters 8 branches

ATMs and cheque-deposit facilities will remain open.

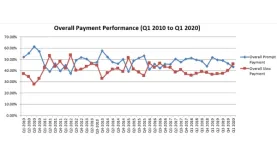

Local firms' payment performance nosedives to three-year low in Q1

Delayed payments made up 45.8% of all transactions during the quarter.

Challenging times ahead for banking industry

Delinquencies are sighted to rise from SMEs, large corporates, and retail customers.

Tokio Marine Life rolls out enhanced protection plan

The #go2gether campaign offers up to 50% coverage against death and critical illness.

Citi to support industry-wide relief programme

The bank also launched relief measures to support its clients.

CIMB Singapore launches relief scheme for commercial banking clients

All principal and interest on all term loans have been automatically deferred.

Credit regulator, NGO launch joint debt relief scheme

It is available to those owing money to banks and licensed moneylenders.

LIA Singapore offers six-month grace period for premiums

Policies will remain valid throughout the period.

SATS issues $200m fixed rate notes

The notes have a fixed coupon rate of 2.88% per annum and are payable semi-annually.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform