China

UOB shuts China outlets over nCov

A small number of staff will remain in Shanghai and Beijing for customer service.

UOB shuts China outlets over nCov

A small number of staff will remain in Shanghai and Beijing for customer service.

Temasek eyes increasing stake in WeWork China

This will push WeWork China’s valuation to around $1.35b.

Reflationary efforts and new year to boost China trade activities in 2020

Exports and imports are foreseen at 0% and 3% YoY, respectively.

ICBC, CCDO, SGX to endorse new renminbi bond indices

The new bond indices can be used as performance basis for investing in RMB bonds.

Chinese court dismisses Weixin claim against OUE Lippo

The Wuxi Xinwu District Court held that a 2015 land transfer between Wuxi Yilin and Wuxi New District Phoenix Hospital was legal.

First Sponsor profits up 30% to $33.3m in Q3

Higher sales in China and the Netherlands boosted the growth.

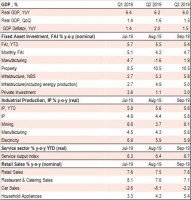

China's GDP slowed to 6% in Q3 2019

The African swine flu outbreak weighed on growth.

1 in 3 senior financial officers worried about global recession risks

27% flagged the impact of trade tariffs on their businesses.

China to dominate electric vehicle parts market

It supplies 40-70% of all global EV components.

China's GDP growth in Q3 slows to 6%

Urban fixed assets investment declined to 5.4% YTD in September.

Chinese property developers can withstand currency depreciation despite sales dip

The companies’ strong revenue will stand as buffers to renminbi depreciation.

Keppel T&T sells stake in Hong Kong and Foshan logistics subsidiaries for $39m

The move aims to recycle capital, enabling the company to pursue other opportunities.

China's outbound M&A likely to stabilize in H2: Natixis

More deals in July and improved offshore financing indicates more outbound activity for the period. Chinese companies may pursue more overseas acquisitions in the H2 amidst a slowing local economy and increasingly low return of assets in China, according to a research by Natixis. Newly announced acquisitions in July indicates that the number of M&A deals by Chinese companies may rise in the second half of the year, in contrast to the trend of decreasing transactions recorded in Q2 and H1, Natixis noted. For example, the automobile company BAIC has just acquired a 5% stake in Daimler, a German automotive corporation. Another reason for the foresight in outbound M&A is the improvement of offshore financing by a dovish FED. Although trade tensions have increased restrictions, dealings with EU stands to have more leeway. EU-27 is still the main target acquisition by China, followed by countries in Asia Pacific and the US. Before Russia topped the value deals of China, EU-27 accounted for about one-third of China’s value deals in cross-border acquisitions in H1, and which largely came from the completed stake purchase in Finland’s Amer Sports. The EU remains to be the most important target of China’s investments in the industrial sector and is also starting to attract Chinese corporates’ attention in the consumer sector. Looking forward, Chinese companies would reportedly prefer to invest in the information and communications technology, as well as the industrial and consumer sectors as these are aligned with the government’s strategic objectives.

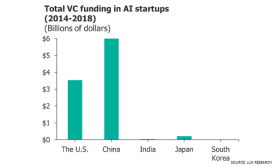

China still lags in AI innovation race despite besting US in patents

Despite scoring $6.1b in funding for its AI startups, Chinese companies may find it hard to capture the Western market. Although investments into China's AI startups dwarf the rest of the world - almost 70% higher than those in the US - a report from LUX research suggests that China has yet to fully cement its status as a global AI leader.

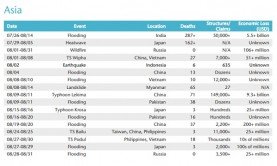

China's economic loss from Typhoon Lekima estimated at $10b

At least 149,000 homes and 1.1 million hectares of cropland were damaged or destroyed.

APAC airline traffic growth slows to six-year low in July

Load factor of 82.6% was below the global average of 85.7%.

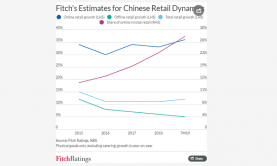

Online retail sales in China grew 36% in July

E-commerce platform Alibaba delivered triple-digit growth in revenue.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?