China

Asia's cruise passenger market up 4.6% to 4.24 million in 2018

China remains the top source market, accounting for 55.8% of Asian passengers. Asia’s cruise passenger source market hit a new high in 2018, with 4.24 million people going on an ocean cruise, up 4.6% YoY, according to data released by Cruise Lines International Association (CLIA). Most of the source markets in Asia saw year-on-year gains in 2018, including Singapore (39.9% to 373,000), India (28.1% to 221,000), Indonesia (54.9% to 72,000), Philippines (49.1% to 61,000), South Korea (13.5% to 44,000), Thailand (14.5% to 30,000) and Vietnam (53.7% to 10,000). Meanwhile, data showed that mainland China retained its dominance as a source market, accounting for 55.8% of all Asian passengers, though the Chinese market has been going through a period of adjustment and saw a marginal 1.6% decline in passengers. The more measured increase in Asia’s passenger volume did not come as a surprise, as cruise ship capacity dipped in 2018 after years of rapid expansion in this region, according to the report. Asia’s slowdown in ship capacity is due to the strong demand for cruise ships worldwide, and reduced short cruise itinerary options ex-mainland China. “In the next few years, cruising in Asia is expected to continue growing in popularity with the arrival of new ships in 2019/2020 including from Costa Cruises, Genting Cruise Lines, Royal Caribbean International and MSC Cruises,” CLIA managing director for Australasia & Asia Joel Katz explained. Asia continues to be the cruise industry’s third largest market after North America and Europe, the CLIA figures show, maintaining a 14.8% share of the total global ocean passenger volume (28.5 million) for 2018.

Asia's cruise passenger market up 4.6% to 4.24 million in 2018

China remains the top source market, accounting for 55.8% of Asian passengers. Asia’s cruise passenger source market hit a new high in 2018, with 4.24 million people going on an ocean cruise, up 4.6% YoY, according to data released by Cruise Lines International Association (CLIA). Most of the source markets in Asia saw year-on-year gains in 2018, including Singapore (39.9% to 373,000), India (28.1% to 221,000), Indonesia (54.9% to 72,000), Philippines (49.1% to 61,000), South Korea (13.5% to 44,000), Thailand (14.5% to 30,000) and Vietnam (53.7% to 10,000). Meanwhile, data showed that mainland China retained its dominance as a source market, accounting for 55.8% of all Asian passengers, though the Chinese market has been going through a period of adjustment and saw a marginal 1.6% decline in passengers. The more measured increase in Asia’s passenger volume did not come as a surprise, as cruise ship capacity dipped in 2018 after years of rapid expansion in this region, according to the report. Asia’s slowdown in ship capacity is due to the strong demand for cruise ships worldwide, and reduced short cruise itinerary options ex-mainland China. “In the next few years, cruising in Asia is expected to continue growing in popularity with the arrival of new ships in 2019/2020 including from Costa Cruises, Genting Cruise Lines, Royal Caribbean International and MSC Cruises,” CLIA managing director for Australasia & Asia Joel Katz explained. Asia continues to be the cruise industry’s third largest market after North America and Europe, the CLIA figures show, maintaining a 14.8% share of the total global ocean passenger volume (28.5 million) for 2018.

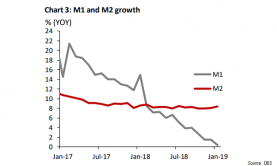

China slowdown to weaken APAC cross-border sentiment in 2019

Chinese corporates' onshore funding costs are forecasted to fall further.

Chinese banks suffer heavy losses as delinquencies hit $17.88b in January

The energy sector saw the most defaults of $6.94b.

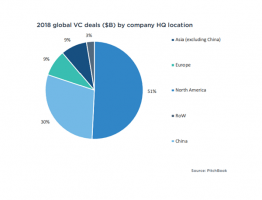

China's VC deal value surged 89% to $78.2b in 2018

Chinese startups clinched almost 1 in 3 global VCs.

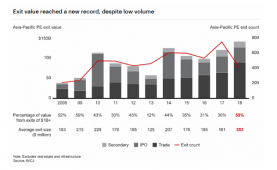

APAC private equity exits hit $142b in 2018

The surge in exit values outpaced the previous all-time high of $125b recorded in 2014.

China to develop platform economy in 2020

The country is aiming to build a commodity circulation system that fits the modern economic system.

China needs US$596.51b of stimulus to reach GDP target

Investments in infrastructure and construction are expected to boost growth.

Chinese TMT IPO proceeds triples to $264.9b in 2018

China Tower Corp, Xiaomi Corp and Meituan Dianping had the largest IPOs in H2 2018.

Asia's fintech investments hit $22.7b in 2018

It was led by online payment provider Ant Financial’s mammoth $14b series C funding round.

China's bloated PPP pipeline hit $1.95t in 2018

The total investment is almost double that recorded in end-2016.

China's PE activity hits record highs at $222b in 2018

It offset the 23% decline in China’s outbound M&A activity which dropped for the third consecutive year.

China's exports rebounded 9.1% in January

Exports to EU, Japan, South Korea and ASEAN have recovered.

China heightens infrastructure spending to prop up slowing economy

The government is actively spending for railway, highways, airports and water conservancy projects.

Solar and wind to snap up 16% of China's power mix by 2028

Cost deflation for wind and solar could sustain the momentum of renewables.

Chinese tech cities accounted for 36% of global VC investments in 2018: report

This translates to $74.8b of the $207.8b investment volumes.

China's outbound M&A likely to slide further in 2019

Regulatory scrutiny from US and Europe and tight funding conditions are to blame.

APAC's asset and wealth managers to hit US$29.6t in AUM by 2025

Shanghai is set to rise as an AWM hub along with Singapore and Hong Kong.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?