Singapore's local M&A deal value poised to hit 3-year high in 2019

The private equity sector is banking on market volatility and has been driving up deal values.

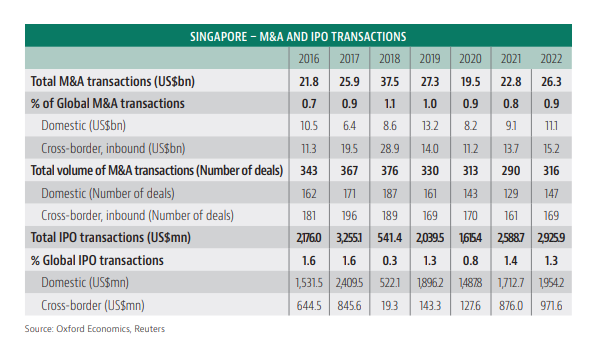

Despite the slowing economy, domestic deal-making activity in Singapore has managed to buck the regional downtrend in 2019, with US$13.2b of merger and acquisition (M&A) transactions across 161 deals expected for the year as a whole, according to Baker McKenzie’s Global Transactions Forecast 2020. These figures are significantly higher compared to 2018, which recorded US$8.6b of transactions made across 187 deals.

Behind the growth of Singapore’s M&A deal value lies rise of private equity’s (PE) share of both M&A and initial public offering (IPO) activity, as PE funds are able to pick up opportunities amidst downturns and volatility, said Andrew Martin, managing principal at Baker McKenzie, in an interview with Singapore Business Review.

Over-leveraged businesses are seeking to sell non-core assets in a bid to decrease their gearing and are giving some motivation on the sell-side, said Min-tze Lean, principal from Baker McKenzie’s M&A practice.

Behind this PE-driven boost, however, has been a market that’s been quieter than usual, Lean said. The number of listed companies has declined for each full-year period since 2013 onwards through to the end of 2018, with expectations that the delisting trend will only gain further momentum.

“The IPO market has also been patchy recently, with several listings having been withdrawn (e.g. PropertyGuru's proposed listing on ASX, Alibaba's proposed listing on HKEx) but some large listings on HKEx still went ahead anyway (e.g. Budweiser Brewing Co APAC),” he said.

Delistings are also expected to continue even as the Singapore Exchange (SGX) has tightened the voluntary delisting requirements, said Lean. “There remains the perception that Singapore-listed stocks are undervalued. SGX continues to be a niche listing venue for REITs," he added.

Creating dry powder

On the bright side, the pressure from stakeholders to deploy “dry powder”, or equities that can be liquidated quickly, will foster some domestic deal-making, according to Martin. “Companies with exposure to domestic market growth within the markets of Vietnam, Indonesia and Thailand remain attractive targets for Singapore and overseas investors. Japan and Korea continue to look for growth through Southeast Asia and are actively seeking that via outbound acquisitions,” he said.

This trend was highlighted in some of the top deals of the year, with Softbank’s US$2b injection into Grab, mostly geared towards additional investments into Indonesia. “North Asian economies are investing in Southeast Asia to spur growth numbers and Singapore companies are continuing to invest domestically,” Martin added.

Singapore’s stability and conducive policies are also expected to weather the turmoil and, in fact, might even boost its hub status. This is further supported by the growth of the investment management sector, which hit 15% YoY between 2012 to 2017, to reach total assets under management (AUM) of US$3.3t, based on data from the Monetary Authority of Singapore (MAS).

“Our report indicates that there will be a modest recovery in deal flows during 2021-22 as trade tensions are expected to normalize,” said Martin, adding that they forecast domestic deal values to recover from US$8.2b in 2020 to US$9.1b and US$11.1b in 2021 and 2022 respectively.

Advertise

Advertise