News

CapitaLand's Raffles City Chongqing achieves 95% retail leasing rate ahead of September launch

CapitaLand's Raffles City Chongqing achieves 95% retail leasing rate ahead of September launch

Adidas Sportswear Collective, Haidilao hotpot and Charles & Keith will open its stores in the mall.

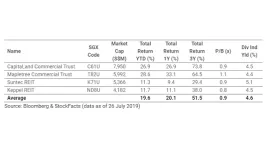

Top office REITs averaged 19.6% YTD return

Mapletree Commercial Trust was the strongest performer with YTD total returns of 28.6%.

UIC profits skyrocketed 186% to $490.4m in H1

Higher sales from trading properties, hotel operations and technology operations boosted earnings.

Frasers Logistics & Industrial Trust's NPI climbed 24.4% to $46.3m in Q3

Acquisitions in Australia and Europe pushed income up.

EU to deny five nations, including Singapore, some market access rights: report

This would remove a status enabling European banks to rely on credit ratings.

DBS profit surges 17% to $1.6b in Q2

Income hit a record $3.71b.

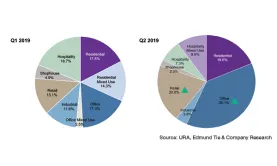

Chart of the Day: Office property investments nearly doubled to $1.9b in Q2

It outgrew the residential segment where investments plummeted to $914.2m.

Daily Briefing: Healthcare subsidy income ceiling to rise by up to $300 in October; Hospitality start-up RedDoorz secures $61.6m in series B round

And Singapore-based robo-advisor StashAway bags $16.4m in series B funding.

Daily Markets Briefing: STI down 0.52%

Singtel fell the most amongst top active stocks with a 4.9% decrease.

HDB resale transactions jumped 29.8% in Q2

Changes to the CPF may have stoked demand for HDB resale flats.

Unemployment rate hits 3.3% in Q2

Employment declined in the retail and manufacturing sectors.

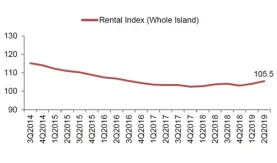

Retail rentals down 1.5% in Q2: URA

However, the prices of retail spaces increased by 0.4%.

Manufacturing output down 6.9% in June

The electronics and transport engineering segments led the decline.

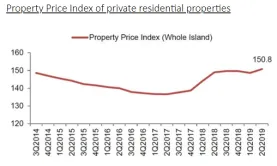

Private home prices rose 1.5% in Q2: URA

Condo prices rose 2% whilst landed property prices fell 0.1%.

Mapletree Industrial Trust eyes international buys to boost overseas AUM to 30%

It could enter third party deals in Europe and Asia to drive DPU growth.

Office prices climbed 0.9% in Q2: URA

Rentals of office space also rose 1.3% in the same period.

Mapletree Commercial Trust's NPI inched up 2.8% to $88.35m in Q1

All properties except Mapletree Anson performed strongly in terms of contributions.

Advertise

Advertise

Commentary

Why Singapore businesses must focus on outvaluing, not just upskilling

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform