News

GIC helped crypto exchange Coinbase raise US$300m: report

The funding boosted Coinbase’s valuation to US$8b.

Singapore still waits for timing of 2% GST hike

It is still monitoring economic conditions as well as expenditure trends and revenue buoyancy.

Daily Briefing: Singapore dollar to strengthen amidst US-China trade truce; US-based hacker-powered security platform HackerOne expands to Singapore

And Singapore-based online luxury marketplace Reebonz faces Nasdaq delisting.

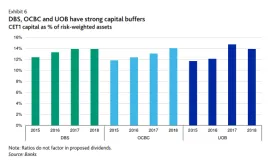

Chart of the Day: Singapore's big three banks' CET1 ratios hit 14% in 2018

DBS and OCBC’s CET1 ratios rose YoY, whilst UOB’s declined due to faster loan growth.

Daily Markets Briefing: STI down 1.15%

Don't expect gains today.

M1 to delist after Keppel buyout

Keppel and SPH now controls 91.15% of M1's shares.

Jardine Cycle & Carriage saw profits plunge by 55% to $566m in FY18

Non-current investments impacted the group’s profits.

Horrible bosses? 1 in 3 Singaporeans are not satisfied with work-life balance due to inflexible managers

For 73%, a work-life balance means no work on weekends, whilst for 69%, it meant being able to leave work on time everyday.

Poll: 67% of Singapore and Hong Kong investors plan to invest in Chinese onshore bonds in 2019

Sentiment was driven by the upcoming Bloomberg Barclays Global Aggregate Index inclusion in April 2019.

Olam's FY2018 profits plummeted 40.1% to $347.87b

It had a large exceptional $149.4m gain recorded in 2017 primarily from the sale of its 50% stake in FEA.

Daily Briefing: Singtel, Axiata team up to launch digital wallet in Malaysia; Fintech firm Rely scores undisclosed investment from a Singaporean family office

And healthcare company DocDoc secures investment from Hong Kong’s Cyberport Macro Fund (CMF).

Daily Markets Briefing: STI down 0.36%

Expect muted gains today.

Chart of the Day: Home resales could hit 9,000-10,000 in 2019

Due to the launch of 60 projects this year, buyers could seek new home sales over resales.

SGX derivatives break volume record with China futures

Derivatives' single-day volume hit 2,872,861 lots on 25 February.

UOL profits crashed 51% to $433.72m in FY2018

It was hit by lower development profits, which was offset by higher UOB dividend income.

Business receipts climbed 4.1% in Q4 2018

The infocomm segment’s business receipts led the growth and jumped 7.2%.

Advertise

Advertise

Commentary

Why Singapore businesses must focus on outvaluing, not just upskilling

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform