News

Daily Briefing: Nearly 10,000 broadband users hit by outage; Keppel Land unveils AI-powered home

And EDBI has pitched in for the latest funding round of a US startup.

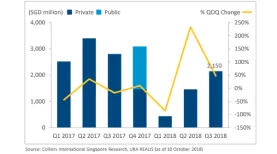

Chart of the Day: Commercial property sales hit $2.2b in Q3

One notable transaction was the $908m sale of OUE Downtown's office component.

SGX ties up with Bank of China and CFETS to globally promote bond indices

SGX will be the first exchange to distribute bond indices outside China.

Medical inflation in Singapore to hit 10% in 2019

Cancer and cardiovascular issues are pushing the medical plan costs up.

9 in 10 Singapore family businesses positive on growth

But only 8% have a formalised succession plan for their next generations.

Olam International Q3 profits fell 14.2% to $20.7m

It blamed tough trading conditions in coffee and weaker performance from its peanut business and commodity financial services.

Golden Wall Centre up for collective sale at $260m

It could be transformed into a mid-sized hotel development.

CapitaLand Q3 profits jumped 13.6% to $362.22m

The increase was due to higher operating income and gains from asset recycling.

SGX to launch new securities settlement and depository system

It will cut its securities settlement cycle from three to two days.

HDB rents rose 0.3% in October

Rents for HDB three-rooms grew 1%.

ST Engineering profits up 5.3% to $134.59m in Q3

Earnings per share grew 5% to $0.432.

Private condo rents dipped 0.7% in October

Rental volumes fell 1.7% to 4,207 rented units.

SIA Q2 profits dropped 80.9% to $56.4m in Q2

It blamed a 40% increase in jet fuel costs and share losses from Virgin Australia.

Daily Briefing: EDBI joins $55.14m funding round for US tech firm; MOH lays out benchmarks fees for surgical procedures in private hospitals

And Kent Ridge Hill Residences sell 46% of units in weekend launch.

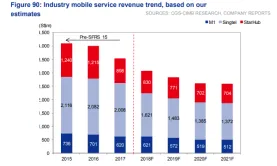

Chart of the Day: See how TPG's entry could impact incumbents' mobile service revenue

Singtel could be an outlier as its EBITDA could expand through higher associate earnings and lower group digital life losses.

Daily Markets Briefing: STI down 0.47%

Wall Street's muted performance could keep the local sentiment cautious today.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform