News

Daily Briefing: SIA keeps 'open mind' on Air India bid; Bank of Singapore eyes family office business expansion

Daily Briefing: SIA keeps 'open mind' on Air India bid; Bank of Singapore eyes family office business expansion

And the worst could be over for Singapore's banking blue chip stocks.

Daily Markets Briefing: STI down 0.61%

Investors are urged to take caution today.

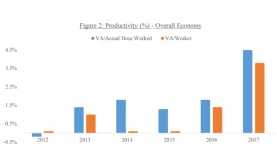

Chart of the Day: Labour productivity rose by 4.5% in 2017

Thanks to gains led by the manufacturing and wholesale & retail trade sectors.

Raffles Medical could be hurt by full-rider insurance changes

About 12-18% of its pre-tax profit is exposed to the insured market.

SIA passenger load factor up 0.2 ppt to 80.9% in February

Higher demand also lifted overall cargo load factor by 0.6ppt.

Export-dependent SMEs fare the worst as 2017 profits nosedive 53.8%

The manufacturing slowdown and higher operating costs derailed its growth.

STI dividends could soar 29% to $20.9b in 2018: IHS Markit

The banking, telecommunication, and real estate sectors are expected to contribute $13.5b to the total.

Local employment nearly doubled in 2017 as economy improved: MoM

But job-skills mismatch continues to be a challenge due to ongoing economic restructuring.

Private home sales crashed 28% to 377 units in February

Most developers are timing their project launches, preferring to wait after the Lunar New Year festivities.

Insurance firms' underwriting profits plunged 58.53% to $107m in 2017

For the first time since 2010, the motor insurance segment generated an underwriting loss, losing $27.2m in 2017.

Small businesses' growth in Singapore is the worst in Asia

Only 47.5% think they grew in 2017, significantly lower than the 68.5% average in the Asia Pacific.

Noble paid US$20m to keep senior staff in US oil unit

In their breakdown, there was a lump sum payment of $3.8m and a loan written off for $3.82m.

Daily Briefing: Singapore probes firms that sold luxury goods to North Korea; UOB is on a hiring spree

And this popular Singapore mall is attempting an en bloc sale for $1.1b.

Daily Markets Briefing: STI down 0.4%

Rising fears of a trade war could weigh local outlook today.

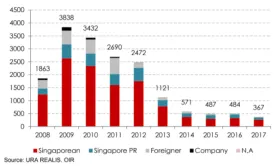

Chart of the Day: Home sub-sales hit 11-year low in 2017

The number of speculative activities has receded over the years.

1 in 5 fintech firms think Singapore doesn't attract enough venture capital

These companies rely on Singapore to attract funds that will allow risk-taking.

Can Perennial revive the ageing Capitol?

An analyst thinks the property could be valued at $1.143b but only if PREH works hard to revive it.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform