News

SIIC Environment eyes dual listing in SEHK

It expects to start share trading on 23 March 2018.

First Resources beats trending decline in fresh fruit bunches growth

Other companies registered drops in FFB production ranging from -1.0% to -16.7%.

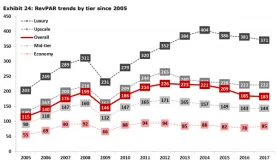

Hotel room supply to increase 1.2% in 2018

Upscale and Mid-Tier hotels clocked a +0.1% revenue per available room (RevPAR) increase in 2017.

7 in 10 businesses unprepared for cloud service outage: survey

They are also unaware of the cost of cloud service interruption.

Hongkong Land 2017 profits up 14% to $1.28b

They were boosted by higher rental income and development profits from China.

Singapore to renew Bukit Panjang LRT for $344.25m

The 19-year-old light rail vehicles will be replaced whilst the two-year-old LRVs will be upgraded.

Top 1000 SMEs profits down 17.1% to $2.9b in 2017

Slow GDP growth and weak global trade are among the challenges that plague SMEs.

Growth of Singapore's women start up founders slowed down to 22%

They are weighed down by their protracted challenges in achieving work-life balance.

SGX RegCo pushes Noble to hire financial advisor

The advisor will look into shareholding structure concerns in Noble’s debt restructuring plan.

CityDev builds fund manager to accumulate $6.57b assets

It wants a constant income stream with less reliance on capital appreciation.

Jardine Matheson Holdings profit up 51.22% to $5b in 2017

Its profits from Mainland China grew 18% thanks to land and manufacturer acquisitions.

Daily Briefing: Temasek leads US$90m funding of Shanghai biotech firm; Singapore's water prices are set to increase by 30% by July 2018

And here are 4 post-independence landmarks targetting en bloc sale.

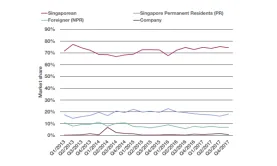

Chart of the Day: 25% of home sales were from non-Singaporeans

They bought 1,324 private condo units, a 0.7% dip in the sales volume.

Daily Markets Briefing: STI up 0.86%

Expect some gains today.

7 in 10 female expats eye Singapore for improved income

Over half of female expats also think it is the best for work culture and personal fulfilment.

Jardine Strategic Holdings profit surged 49.17% to $10.84b in 2017

Jardine Matheson’s profit contribution rose to $491.04m or 4.5% of the total.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform