News

Local employment nearly doubled in 2017 as economy improved: MoM

Local employment nearly doubled in 2017 as economy improved: MoM

But job-skills mismatch continues to be a challenge due to ongoing economic restructuring.

Private home sales crashed 28% to 377 units in February

Most developers are timing their project launches, preferring to wait after the Lunar New Year festivities.

Insurance firms' underwriting profits plunged 58.53% to $107m in 2017

For the first time since 2010, the motor insurance segment generated an underwriting loss, losing $27.2m in 2017.

Small businesses' growth in Singapore is the worst in Asia

Only 47.5% think they grew in 2017, significantly lower than the 68.5% average in the Asia Pacific.

Noble paid US$20m to keep senior staff in US oil unit

In their breakdown, there was a lump sum payment of $3.8m and a loan written off for $3.82m.

Daily Briefing: Singapore probes firms that sold luxury goods to North Korea; UOB is on a hiring spree

And this popular Singapore mall is attempting an en bloc sale for $1.1b.

Daily Markets Briefing: STI down 0.4%

Rising fears of a trade war could weigh local outlook today.

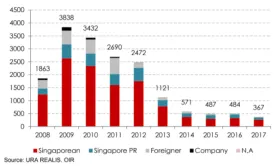

Chart of the Day: Home sub-sales hit 11-year low in 2017

The number of speculative activities has receded over the years.

1 in 5 fintech firms think Singapore doesn't attract enough venture capital

These companies rely on Singapore to attract funds that will allow risk-taking.

Can Perennial revive the ageing Capitol?

An analyst thinks the property could be valued at $1.143b but only if PREH works hard to revive it.

Brace for Netlink NBN's network dominance

It’s the only fibre network operating 76,000 km of fibre cable, which has nationwide coverage.

MAS to enforce new data collection rules

It aims to reduce data duplication and automate financial institutions’ submissions.

Uber unveils carpooling service

Rides will be 51% cheaper than UberX rates.

156 banks in Singapore target inclusive hiring

They will comply with an advisory that also covers HR issues like the impact of technology on workers and retrenchments.

OCBC opens AI unit with $10m investment

Its services in wealth advisory and loans financing are bracing for AI upgrades.

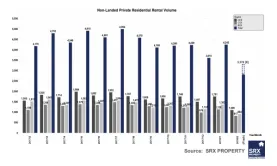

Rental volume of HDB flats and private condos crashed in February

The rental volume of private condos fell 20.4%, whilst the volume of HDB flats rented fell 19.1%.

Economists raise GDP forecasts to 3.2% in 2018

They are more positive thanks to manufacturing growth but are also more worried by a possible global trade war.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform