News

Daily Briefing: World's oldest billionaire lives in Singapore; GIC and Temasek in talks for $1.5b 'Salt Bae' resto deal

Daily Briefing: World's oldest billionaire lives in Singapore; GIC and Temasek in talks for $1.5b 'Salt Bae' resto deal

And here's why Singapore's debt consolidation plan might not be working.

Daily Markets Briefing: STI down 1.18%

Investors are urged to take caution today.

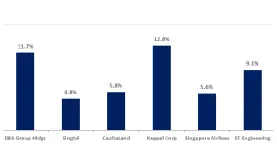

Chart of the Day: Temasek's major stock investments yielded 8.1%

Its investments in Keppel paid off the largest at 12.8%.

Noble's debt restructuring plan hit by suspicions

A wording on the “full release” of claims by senior creditors could absolve Noble legal debt claims.

3 in 10 firms hit by staff diversity woes

Only 53% also have a formal diversity policy, a drop from 58% in 2017.

Ng brothers are Singapore's richest in 2018

Their net worth of US$10.8b got them 140th place in the world rankings.

Crazy rich Singaporeans: 1 in 25 of Asia's ultra-wealthy call Singapore home

There are 1,400 individuals in Singapore with a net worth of over US$50m.

S-REITs market sparks US asset listings

Analysts expect two more listings to follow Keppel-KBS US REIT’s footsteps.

Private condo prices hit record highs

The average price of non-landed homes reached a new high of $1,427 psf in January to February 2018.

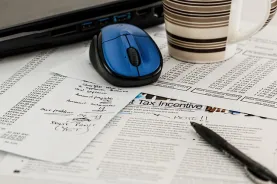

ACRA cuts firms' tax filing length to 6 steps

The new process will potentially benefit 150,000 companies.

Soho builds LinkedIn for properties

It raised $1.71m to double product development speed and team size at their Singapore headquarters.

soCash puts the heat on ATM machines as Singapore digitises

The fintech start-up aims to turn ordinary stores into cashpoints.

Senoko ready to sell electricity to consumers from April

Singapore’s largest power producer gets ready for power market liberalisation.

No country for old men: Singapore and HK budget differences indicate policy divergence

The recent budgets delivered in Singapore and Hong Kong show differing paths to deal with an ageing society.

Daily Briefing: HDB junks flat sale rule for divorcees; Luxury firm halts blue diamond ICO

And here's a startup that will let you buy electricity through blockchain.

Chart of the Day: Mass market apartments are 2.4% cheaper in January-February 2018

The average price is $1,117 psf.

Daily Markets Briefing: STI up 1.55%

STI may attempt to make a technical rebound today.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform