New completions to ramp up residential vacancy rates in Q1

This could cause prices of nearby older homes to stagnate.

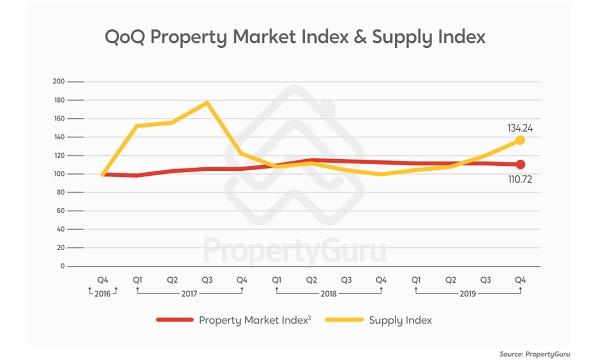

Newly completed private residential properties could likely contribute to rising vacancy rates in Q1, according to PropertyGuru’s Singapore Property Market Index.

The report noted that recently completed condos with a significant number of unsold balance units could cause prices of older homes in the vicinity to stagnate, especially when the condo resale market is facing keen competition from new launches.

“It is important to note that, given the relatively low number of prospective buyers in the market today, any observed increase in asking and transaction prices will likely remain localised on a district-level in 2020, as opposed to a nationwide uptrend in property value,” the report stated.

Condo supply rose 13.3% QoQ to 78,184 in Q4 2019. Meanwhile, statistics from Urban Redevelopment Authority (URA) showed that the vacancy rate contracted 10.3% for completed private residential units whilst the number of planned units declined 3.5%.

This could mean that newly-placed resale units were the main contributors to the growth of listings in the past quarter, rather than newly launched, uncompleted units, the report noted.

The asking prices of condos in the market also fell 0.7% in Q4, attributed to a rise in activity on the part of sellers in the resale market, the report noted. For the full year, it would have climbed if not for an influx of units from newly launched condos following a collective sale frenzy in 2017 and 2018.

If enough of the new supply is absorbed, PropertyGuru expects prices overall to trend upward again in 2020, as long as a borrower-friendly low interest rate environment prevails.

Some districts may have also hit a ceiling regarding price growth, with the median psf asking price in District 28, which had experienced one of the biggest increases in median asking price over the past three years, appearing to have plateaued in 2019.

The district’s rapid growth largely owes itself to amenities that have largely become complete. Further, the supply in the district has outpaced demand, as the number of recorded listings on PropertyGuru surged 80% over the past three years.

An increase in the number of investors looking to cash out their property purchase could also drag asking prices, following the lapse of their three-year Seller Stamp Duty (SSD) liability periods.

According to PropertyGuru’s country manager for Singapore Tan Tee Khoon, investors may consider liquidating their assets, feeling that the value of their properties will not appreciate as much as it did in the past few years.

Advertise

Advertise