Private condo prices up 1% in March

Prices in non-Central areas climbed 1.6% and led growth.

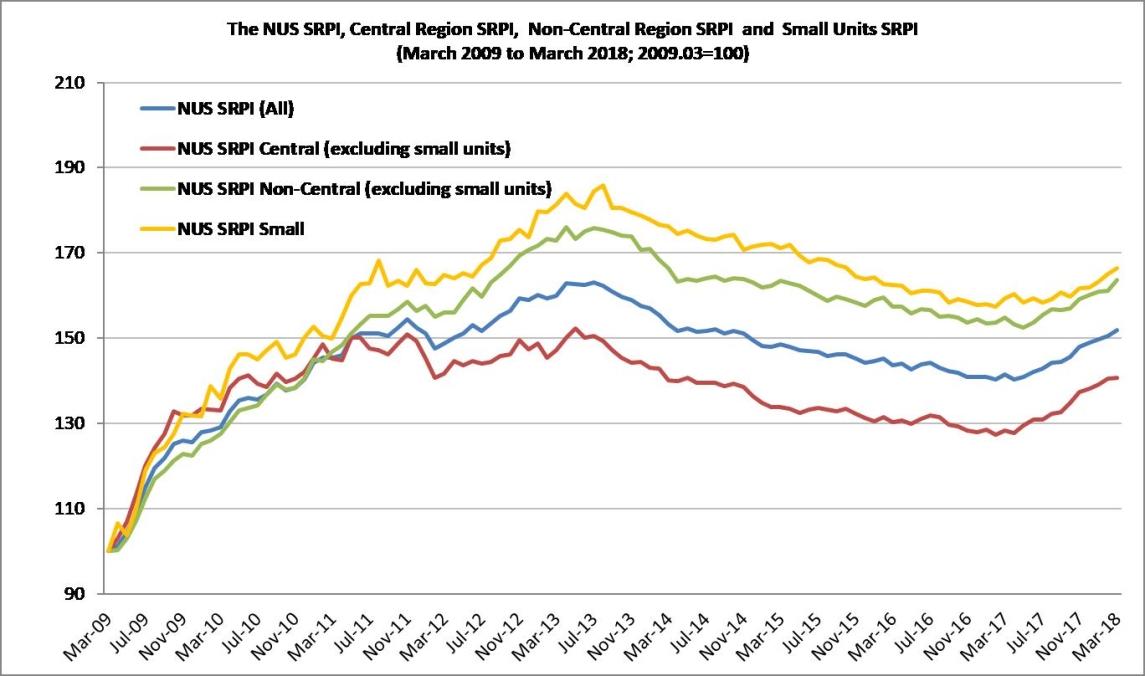

The prices of private condos jumped 1% from February to March 2018, the National University of Singapore (NUS) revealed in its Singapore Residential Price Index Series (SRPI). This is significantly higher than the 0.5% growth in February.

According to the index, the index value of prices in non-Central areas (excluding small units) climbed 1.6% and led the growth for the month. This beat the 0.1% growth in February.

Meanwhile, the index value of prices in Central areas, excluding small units, jumped 0.1%. This is slower than the 1.1% change in February.

The prices of small units, rooms with a floor area of 506 sqft or below, jumped 0.9%.

The Central region sub-basket comprises properties within the overall SRPI basket located in Postal Districts 1 through 4 and 9 through 11 whilst properties in the other postal districts are in the non-Central region sub-basket.

Advertise

Advertise