Singapore's data centre capacity to hit 380MW by 2022

But the growing cloud business could reduce the demand for colocation services if colocation tenants make the switch.

Over 2015-2018, an average of 35MW of supply was added to the data centre market per annum in Singapore, according to a report by CGS-CIMB. The average supply from 2019- 2022F is expected to be about 50MW per year.

CGS-CIMB analyst Lock Mun Yee and Ervin Seow said that they expect over 380MW of new data centre capacity to come onstream over 2019-2022F, which translates to around 95MW per year on average.

The report noted that the larger developments are sites owned by end-users such as Google and Facebook, whilst the rest appear to be data centres in the colocation space. “The 150MW data centre at Tanjong Kling will be Facebook’s first data centre in the region. Facebook does not have a substantial cloud business like Amazon and Google and so we do not expect its new data centre to displace demand from other colocation providers like Keppel DC REIT,” they said.

Without the Facebook development, average incoming supply would be approximately 58MW per year over 2019-2022F. Google has historically built and owned its data centres due to a sizeable cash balance on its books.

Lock and Seow also noted that the impact on displacement from Google’s own demand on other colocation data centres could be limited. Google's data centre development at Jurong West St 23 is its third data centre development in Singapore.

Also read: Can Singapore cement its data centre dominance before Asian upstarts steal crown?

“However, a growing cloud business could reduce the demand for colocation services if underlying colocation tenants make the business decision to switch their enterprise systems to cloud-based services. The actual impact on demand displacement could also be difficult to gauge due to the multinational nature of Google’s cloud services, and cloud services demand from the region could be hosted on a data centre in Singapore,” they added.

Assuming that 10% of the new capacity would be for Google’s own use and another 30% for overseas cloud demand, the effective average incoming supply would be roughly 48MW over 2019-2022F, excluding Facebook’s development.

According to the Cisco Global Cloud Index, data stored in data centres is expected to grow at a 34% compound annual growth rate (CAGR) to reach 1.3 zetabytes by 2021F. Much of this data migration towards data centre storage can be attributed to the rapid adoption of cloud computing services.

This trend is also corroborated by data from Synergy Research showing that hyperscale operator capex has been catching up with telcos, which were traditionally the largest users of data centres. In 2018, the aggregate capex of the top 5 hyperscale spenders comprising of Google, Amazon, Microsoft, Facebook and Apple was almost identical to the capex of the top 5 telco spenders China Mobile, AT&T, Verizon, NTT and Deutsche Telekom.

“Within the cloud service providers, we note that large scale providers have gained market share over the past four quarters at the expense of small and medium-sized cloud operators, who have collectively lost 5% pts of market share over the same period,” Lock and Seow said.

As the use of public cloud becomes increasingly prevalent, the analysts also expect a shift in data centre demand from the colocation space of individual corporates to the cloud space of cloud service providers.

According to research from BroadGroup Consulting cited by CIMB, demand for data centre facilities is expected to follow global trends and be driven by large hyperscale providers which could potentially take up around 40% of Singapore’s colocation space. “It expects the bulk of the remaining 60% space to be taken up by telcos, multinational organisations, and banking and fintech services companies,” the analysts noted.

"As hyperscale providers increasingly take up greater space, we think that other data centre tenants could face a supply crunch for large space and this also could push rents up," Lock and Seow said, with CIMB noting that BroadGroup expects new demand to average approximately 50MW per annum in Singapore.

Overall, Lock and Seow think that the stronger demand will help absorb the large incoming supply. “We think the facilities being developed by Google and Facebook will come onstream in phases which will allow time for the excess supply to be absorbed, especially for Google's data centre that could draw some demand from existing colocation tenants,” they highlighted.

However, the increased supply absorption from tenants that will be lured by the tech giants will not be beneficial to local developers and owners like Keppel DC REIT in the long run, Lock and Seow argued. Without any new acquisitions in Singapore, the benefits for Keppel DC REIT would be limited in the short term due to the average weighted average lease expiry of three years for its Singapore assets.

“Additionally, it would be unable to fully benefit from the uptick in demand due to the lack of significant spare capacity at its existing data centres in Singapore. In order to continue achieving the earnings and distribution per unit (DPU) growth it had in prior years, we think Keppel DC REIT would have to continue its acquisitions to attain greater capacity which would allow it to benefit from expected improvements in rental rates,” they said.

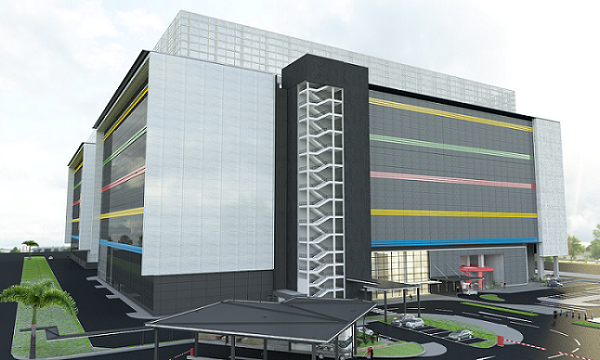

Keppel’s Keppel DC Singapore 4 (SGP 4) data centre could be considered a low-hanging fruit given how it can be injected into Keppel DC Reit as early as H2 2019 upon stabilisation. SGP 4 has a gross floor area of more than 182,000 sqft over five floors and was acquired for $20m in 2015 from Mapletree Logistics Trust. The facility reportedly achieved its temporary occupation permit (TOP) in mid-2017 and is fitted out to Tier 3 concurrent maintainability standards.

Advertise

Advertise