Keppel's infrastructure arm turns to 2 projects for growth

Its Marina East Desalination project could boost headline earnings by 5-6%.

According to UOB Kay Hian, investors shouldn’t just look at the new star of Keppel's show, the property segment. The brokerage turned the spotlight on its energy infrastructure & services, which grew by 38% YoY in 2017 and contributed 10-12% of 2017 core PATMI thanks to higher sales of electricity and gas.

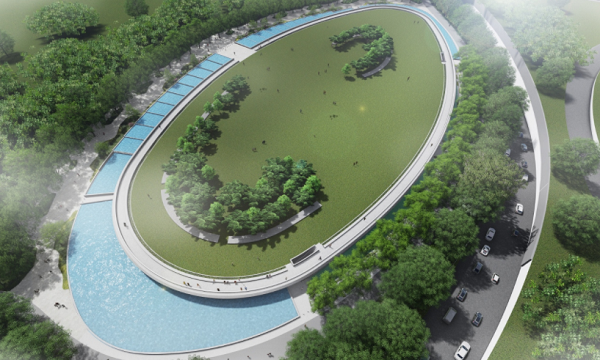

In a report, UOBKH analyst Foo Zhi Wei noted that profits were boosted by contributions from the Marina East Desalination project which commenced construction in H2 2017. “Assuming a 10% net margin, we expect the Marina East Desalination engineering, procurement, and construction (EPC) project to add $7.5m to the bottom line for 2018, representing 5-6% growth from 2017’s headline earnings of $107m for Infrastructure,” she added.

At the same time, 2018 could also see earnings contribution from the Hong Kong Integrated Waste Management Facility (HK IWMF) contract secured on 1 December 17. “The HK$11.3b ($1.95b) contract, is roughly evenly split between the EPC and operations & maintenance (O&M) contract. Details are scant, but assuming a 10% net margin, we estimate the project to contribute an additional S$9m to EPC earnings in 2018, and an additional S$13.5m earnings in 2019,” Foo added.

The earnings from O&M contracts tackled by Keppel Seghers are also expected to back up the growth. Foo said, “As of 2017, recurring maintenance revenue for Keppel Infrastructure’s (KI) as a whole stood at $160m p.a. and will grow to an estimated $208m by the end of 2024, driven by O&M contracts from Marina East and HK IWMF. This is on top of the earnings derived from its electricity, gas and District Heating and Cooling System (DHCS) businesses.”

Keppel also announced that it had secured £4m worth of performance bonuses, as well as a £3.25m Technical Support Agreement for a period of five years starting 2018.

Foo concluded that with infrastructure earnings set to contribute around 15% of Keppel’s 2018 earnings, the two large EPC projects will be closely watched. “This is expected to grow if Keppel secures the upcoming tender for Singapore’s own IWMF in Tuas. Tender submissions are currently scheduled for H2 2018, with construction likely to commence in 2019. However, as it stands, we expect earnings growth from the two aforementioned projects alone up till 2020.”

Advertise

Advertise