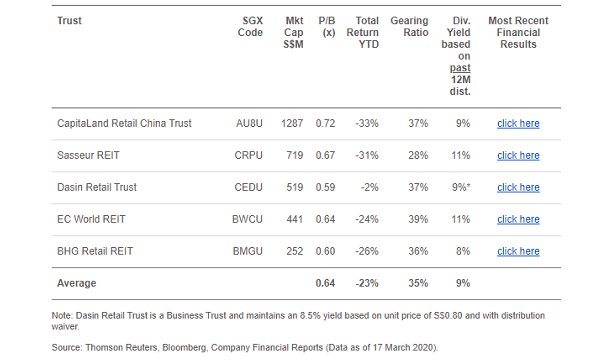

Returns of China-focused S-REITs down 23% in March YTD

CapitaLand Retail China Trust led the declines with a 33% drop in returns.

The average total returns of the five S-REITs focusing on the China market has crashed 23% in 2020 YTD, reversing the 21% returns recorded by end-2019, according to an SGX report.

This figure is led by CapitaLand Retail China Trust (CRCT) as its returns dropped 33% during this period, followed by Sasseur REIT as it slipped 31%. BHG Retail REIT posted negative returns of -26% in March YTD, EC World REIT’s returns fell 24%, whilst Dasin Retail Trust only has a 2% dip on returns.

Overall, the average price-to-book (P/B) ratio for the five property trusts is now 0.64x, converging with 150 property stocks listed in Singapore, Hong Kong, Japan, Australia and Taiwan, that generate all their revenue in China. At end-2019, the five trusts averaged a 0.89x P/B, a 19% premium to the peer group.

Based on their most recent filings, the 150 real estate stocks listed across the exchanges of the five countries that report all their revenue to China maintain a median debt-to-equity (DTE) ratio of 83% and median return-on-equity (ROE) of 9%.

SGX noted that by comparison, four China-focused S-REITs maintain lower DTE and higher ROE. The cash flow per unit for all five property trusts are also higher than the median cash flow per share of the 150 real estate stocks.

On a positive note, Sasseur REIT reopened its four outlet malls with a 29% YoY surge in sales that hit $2.33m (RMB11.46m). Its Bishan outlet mall recorded the highest rise in sales at 228% to $390,910 (RMB1.92m), followed by Kunming (171%) and Chongqing (132%) outlet malls, recording first day sales of $386,840 (RMB1.9m) and $1.15m (RMB5.64m), respectively.

As for the other REITs, BHG Retail REIT announced on 10 March that Hefei Mengchenglu Mall and Hefei Changjiangxilu Mall had reopened upon approval from the relevant local authorities.

A few days before that, CRCT noted that of its 13 operational malls in China, CapitaMall Minzhongleyuan in Wuhan had been closed and will reopen when local conditions permit. CRCT added that the mall represented less than 3% of CRCT’s portfolio value as at 30 September 2019 and contributed approximately 0.5% of CRCT’s net property income for the first nine months of 2019. CRCT maintained that it did not expect the temporary closure to have a material impact on their FY2020 performance.

Advertise

Advertise