Average Grade A CBD office rents hit a decade high at $10.63 psf in Q1 2019

Rents in the Marina Bay submarket led the increase.

Singapore’s office property market started the year on strong footing with the Q1 2019 Central Business District (CBD) Grade A rents nudging past the recent peak to hit a decade high of $10.63 psf per month, JLL’s preliminary estimates showed.

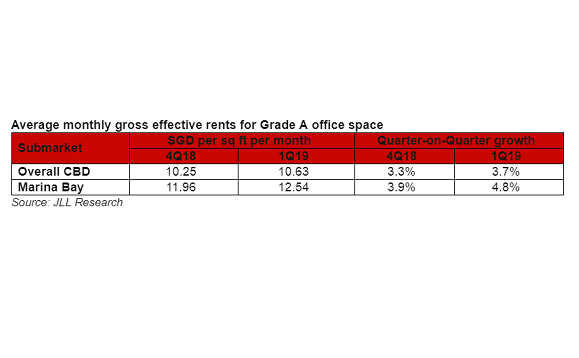

The 3.7% QoQ rise in monthly gross effective rents of Grade A CBD office space is said to be 0.7% above the recent peak of $10.56 psf per month recorded in Q1 2015. It is also the highest rent recorded since Q4 2008 when rents stood at an average of $12.55 psf per month.

“Q1 2019 rent growth was broad-based across all submarkets, with Marina Bay in the lead. As of the end of Q1 2019, the average monthly gross effective rent of Grade A office space in the Marina Bay submarket stood at $12.54 psf after rising 4.8% QoQ from $11.96 psf in Q4 2018,” JLL noted.

Also read: Grade A CBD office rents inched up 9.5% in 2018

But whilst many occupiers are still keen to have a CBD presence, the limited availability of good quality space for lease, based on most Grade A office developments in the CBD enjoying near-full occupancies, is driving rentals steadily upwards, Chris Archibold, head of leasing at JLL Singapore, commented in a statement.

JLL’s preliminary research also showed that the average vacancy rate of Grade A office space in the CBD tightened from 7.2% in Q4 2018 to just 6% in Q1 2019. The squeeze for space led to Q1 2019 rent growth accelerating to 3.7% QoQ from the 3.3% QoQ observed in Q4 2018.

By the end of Q4 2019, when more occupiers have committed to space in recent completions such as Frasers Tower and 18 Robinson move in, JLL forecasts that the average vacancy rate of Grade A office space in the CBD could plunge below the frictional level of 5%.

“No relief is seen for supply any time soon. This is because the next office completion in the CBD will likely be 79 Robinson Road and Afro Asia i-Mark which are expected to provide some 0.7 million sqft of office net lettable area in total only from 2020,” JLL highlighted.

It also noted that the refurbished Chevron House could also return to the market in 2020, whilst developments CapitaSpring and Hub Synergy Point are expected to come on stream in 2021, followed by IOI Properties’ Central Boulevard project and Guoco Midtown in 2022. The Shaw Tower redevelopment could be completed in 2023. Altogether, these will generate an average annual new supply of approximately 1.0 million sq ft from 2020 to 2023.

“With the next new office development in the CBD expected to come on stream only from H1 2020 onwards, upward pressure on rents is unlikely to abate any time soon. This is especially in view that schemes completing outside the CBD this year (e.g. Funan and 9 Penang Road) are seeing keen occupier interest and could enjoy healthy pre-commitments, including forward leasing deals,” Tay Huey Ying, head of research and consultancy for JLL Singapore, added. “They are thus unlikely to significantly ease upward pressure on CBD Grade A rents as earlier envisaged.”

Advertise

Advertise