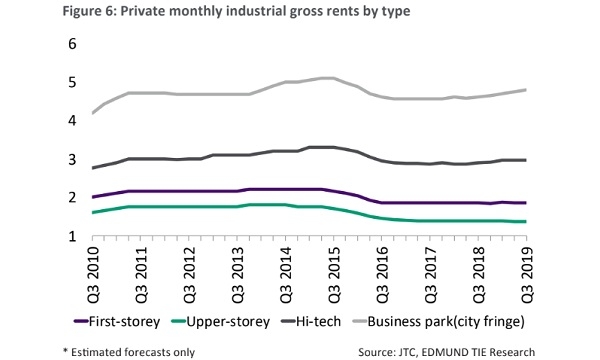

Chart of the Day: Industrial upper storey rents may fall by 0.75% in Q3

Rents are largely expected to trend downwards due to weakening manufacturing and trade.

This chart from Edmund Tie & Co. reveals that industrial upper storey rents are forecasted to have fallen 0.75% QoQ between the $1.38 to $1.58 range in Q3.

First-storey rents are also projected to have fallen 0.5% QoQ to the $1.73 to $1.98 range. In contrast, city-fringe business park rents are forecasted to have risen 1% QoQ to a range between $4.35 to $4.85.

High-tech industrial rents remained the same at $2.85 to $3.05.

“Rental rates are largely expected to trend downwards on the back of weakening manufacturing and wholesale trade sectors, although the easing of NODX and PMI may indicate a possible ‘bottoming out’. In addition, the limited supply pipeline may provide some level of support to rental levels,” noted Edmund Tie & Co.

Rents for city fringe business parks rose likely due to the limited availability of suitable existing space and new supply, the report added.

Advertise

Advertise