Industrial property occupancy rates inched up 0.6 pp in Q2

Multiple-user factory spaces recorded a 1.2 pp increase in occupancy to 87.2%.

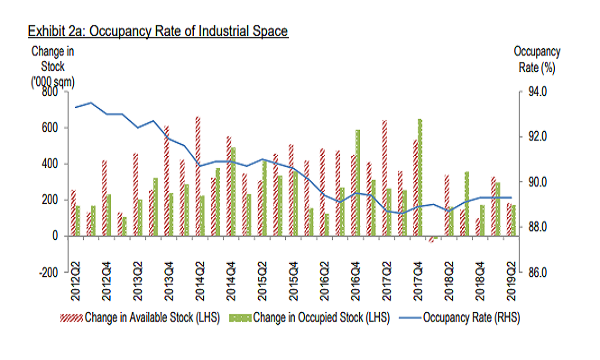

The occupancy rate of Singapore’s overall industrial property market edged up by 0.6 pp YoY in Q2, a quarterly market report by JTC revealed. Prices fell 0.1% YoY.

Occupancy rates for multiple-user factory spaces saw the largest growth, with occupancy rates rising by 0.9 pp QoQ and 1.2 pp YoY to 87.2%. Following closely behind were business parks with a 1 pp YoY and 0.4 pp QoQ advance to 86%. On the other hand, single user factories and warehouses witnessed a 0.3 pp and 0.5 pp QoQ drop in occupancy rates to 90.9% and 88.7%, respectively.

According to Christine Li, head of research for Singapore and Southeast Asia at Cushman & Wakefield, the muted demand could be a reflection of the US-China trade tension which has undermined business expansions and investment plans.

“On the bright side, a number of global firms are still pouring investments into new facilities in Singapore. Corteva Agriscience opened its Asia-Pacific headquarters at Biopolis,” she highlighted. “American medtech firm PerkinElmer launched its life science lab at JTC MedTech Hub to manufacture detection and analytical instruments. In addition, German conglomerate Thyssenkrupp has plans to set up a Singapore Manufacturing TechCentre Hub later this year to unlock the potential of 3D printing solutions across various industries.”

Based on the number of caveats lodged for industrial properties, JTC noted that there was an increase in the transaction volume, jumping 24% QoQ and 28% YoY, in Q2.

Rentals of industrial space remained stable in Q2, with the rental indices of both overall industrial space and multiple-user factory spaces rising marginally by 0.1% on a QoQ basis. YoY, rental index for overall industrial space remained unchanged whilst rental index for multiple user factories slipped 0.3%.

Li noted that the rise in the rental index marked the first quarterly increase in five years since Q1 2014. “However, due to the worsening macro-economic conditions, the temporary rebound in the rental index is unlikely a sign that the industrial market is out of the woods,” she explained.

Also read: Industrial property sales jumped 27.6% to $1.3b in Q1

Meanwhile, prices of industrial space also remained relatively stable, with the price indices for overall industrial space and multiple-user factory space dipping 0.1% and 0.2% QoQ, respectively, in Q2. YoY, the price index of both overall industrial space and multiple-user factory space dropped 0.1% and 0.4%, respectively.

In Q2, JTC allocated a total of 64,800 sqm of ready-built facilities (RBF) space to industrialists, which included 48,600 sqm of high-rise space and 10,900 sqm of land-based factory space. “Amongst the high-rise space that was allocated, about 69% was in JTC’s newer developments such as JTC Poultry Processing Hub @ Buroh, trendspace, JTC Space @ Tuas, JTC Food Hub @ Senoko and LaunchPad @ one-north,” the firm said.

Total RBF returns in Q2 was 50,000 sqm, of which 31,800 sqm was high-rise space and 10,200 sqm was land-based factory space. About 42% of the total returns was due to natural expiries or companies consolidating their operations.

As well in Q2, the tenders for three Industrial Government Land Sales (IGLS) sites targeted at single-user developments, zoned for Business 2 use were closed, although none were awarded. “The bid price at Tampines North Drive 3 was below the reserve price and there were no bids for sites at Jalan Papan and Gul Circle,” JTC said. The combined large area of the sites was 2.6 ha.

On the other hand, the tender for an IGLS site at Gambas Way, targeted at multiple-user development, was closed in Q2. The 1.2-ha site, zoned for Business 2 use, attracted four bids and was ultimately awarded with a successful bid price of $1,339 psm ppr.

Besides IGLS, JTC also allocated 91.2 ha of prepared industrial land (PIL) during the quarter. About 63% of the land (57.3 ha) was allocated to manufacturing companies, whilst the remaining was allocated to companies in the manufacturing-related and supporting industries. An approximate 69.1 ha of PIL was returned to JTC, with natural expiries accounting for 77% of the total returns.

For the rest of 2019, another 900,000 sqm of industrial space is estimated to come on-stream, whilst in 2020, around 1.7 million sqm is expected to be completed. “As a comparison, the average annual supply and demand of industrial space were around 1.3 million sqm and 1.2 million sqm, respectively, in the past three years,” JTC said.

JLL expects industrial developments with higher building specifications catering to the needs of new economy firms and firms from higher value-added industries to remain sought after. “Notably, barring any unforeseen external shocks, the business park segment is expected to outperform the rest of the market in 2019, given the tight supply of quality business park space for lease for the rest of 2019,” Tay Huey Ying, head of research and consultancy for JLL Singapore, noted.

Advertise

Advertise