Office prices jumped 3% in Q1: URA

Total supply grew to 733,000 sqm gross floor area of office space in the pipeline.

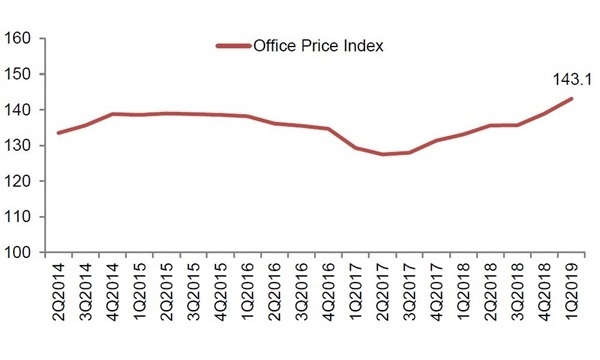

Prices of office space jumped 3% in Q1 2019, marking a continued ascent from the 2.4% increase in Q4 2018, the Urban Redevelopment Authority (URA) revealed. Rentals of office space dipped 0.6% in Q1, reversing the 0.5% increase in the previous quarter.

As at the end of Q1 2019, there was a total supply of about 733,000 sqm gross floor area (GFA) of office space in the pipeline, compared with the 732,000 sqm GFA of office space in the pipeline in the previous quarter.

Meanwhile, the amount of occupied office space increased by 19,000 sqm (nett) in Q1, 51% lower compared with the increase of 39,000 sqm (nett) in the previous quarter.

The stock of office space shrank by 6,000 sqm (nett), compared with the increase of 59,000 sqm (nett) previously.

As a result, the island-wide vacancy rate of office space declined to 11.8% as at the end of Q1, from 12.1% as at the end of Q4 2018.

Advertise

Advertise