8 support measures for businesses outlined in the 2022 budget

The measures focus on three objectives.

The government will be extending the implementation of its old measures, and will also be implementing new initiatives to further support businesses in Singapore in 2022.

As outlined in the 2022 budget, the government will be enhancing its financing support, investing in digital capabilities, and encouraging enterprise and workforce transformation.

The government aims to achieve these three goals through the following programmes:

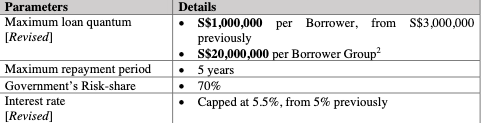

a. Temporary Bridging Loan (TBLP)

The programme which provides businesses with access to working capital will be extended until 30 September 2022, complemented by a concurrent extension of the MAS SGD Facility for Enterprise Singapore Loans.

Some parameters of the programme were also revised given the continued impact of COVID-19 and the recent increase in business costs.

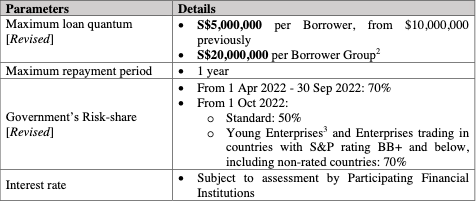

b. Enterprise Financing Scheme – Trade Loan (EFS-TL)

Like TBLP, EFS-TL was also extended until 30 September 2020 to help more Singapore-based businesses in their trade financing needs, which include the financing of short-term import, export, and guarantee needs.

Beyond the programme implementation, the government will maintain an enhanced risk-share of 70% for young enterprises and enterprises trading in countries with S&P rating BB+ and below, including non-rated countries.

Revisions made in the scheme’s parameters are as follows:

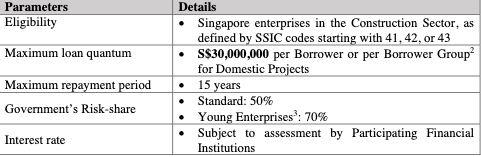

c. Enterprise Financing Scheme – Project Loan (EFS-PL)

To support Singapore-based enterprises on their overseas project financing needs, like financing of working capital, guarantee, and fixed assets, the EFS-PL will be extended 31 March 2023.

This scheme is primarily targeted to assist construction enterprises in fulfilling domestic projects amidst rising costs and tightened cash flow.

The parameters of the enhanced EFS-PL are as follows:

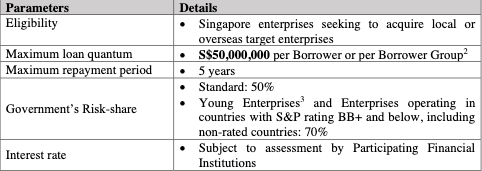

d. Enterprise Financing Scheme – Merger & Acquisition Loan (EFS-M&A)

The scheme will undergo several enhancements From 1 April 2022 to 31 March 2026, to help enterprises scale and expand through mergers and acquisitions (M&A), including venturing into complementary businesses and emerging sectors.

Enhancements made in the scheme’s parameters are as follows:

e. Advanced Digital Solutions (ADS)

The Infocomm Media Development Authority-led initiative will be expanded from 1 April 2022 and will now include solutions that leverage Artificial

Intelligence (AI) and Cloud technologies to help enterprises improve operational efficiency and business decisions.

“Participating enterprises will receive up to 70% funding support for these solutions,” the government said.

f. Grow Digital Scheme

With the to help more businesses “internationalise without requiring an in-market

presence,” the government will expand the scheme to include more pre-approved digital platforms.

The added platforms are expected to help SMEs “reach new markets more effectively, such as through AI-powered business matching to connect SME suppliers with potential overseas clients, cross-border e-payment facilities, and training to build competitive, globally-oriented businesses.”

g. TechSkills Accelerator (TeSA)

To build a stronger pool of ICT talent in Singapore, the government will expand the initiative on several fonts including partnering with industry leaders to grow product development teams in the state (expanding TeSA to SMEs and startups to provide more job opportunities for mid-career workers, and upskilling current digital workforce to keep their skills relevant.

h. SkillsFuture Enterprise Credit (SFEC)

To encourage more employers to undertake enterprise and workforce transformation initiatives, the government has adjusted the criteria for SFEC eligibility.

Under the 2022 budget, employers will no longer need to have a minimum Skills Development Levy (SDL) contribution requirement over

the qualifying period of 1 January 2021 to 31 December 2021.

This provision excludes employers with inactive ACRA status during the

qualification process and employers who have defaulted on their SDL payment during the qualifying period.

Under SFEC, eligible employers can receive a one-off credit of up to $10,000 to cover up to 90% of out-of-pocket expenses for supportable enterprise transformation programmes and workforce transformation programmes.

Of the $10,000 credit for an eligible employer, $3,000 is ringfenced for workforce transformation initiatives.

Advertise

Advertise