Credit financed 46.4% of Singapore's business-to-business sales

Businesses actively opt for trade credit as part of ‘common practice’.

After a steep decrease from 54.5% in 2016, the average proportion of B2B sales in Singapore made on credit increased again in 2018 to 46.4%, Atradius revealed. Only transactions in the country reported higher use of trade credit amongst Asia Pacific countries (down from 45.9% in 2017 to 43.6%).

According to its Payment Practices Barometer, Singapore businesses actively opt for trade credit because they are “common practice” for both their domestic and foreign B2B customers.

They will only reject grant credit terms to their domestic B2B customers due to poor payment behaviour (cited by 50%), lack of knowledge on their customers’ business and payment performance (25%), and high economic or political risk (25%).

High economic or political risk would refrain them from offering credit terms to B2B customers abroad (mentioned by 68.2%). Another frequent reason is high currency risk (mentioned by 40.9%).

"It is more convenient to pay for our business services using credit than any other payment methods and we have trust in our customers to make prompt payment," said an unnamed survey respondent from the business services sector.

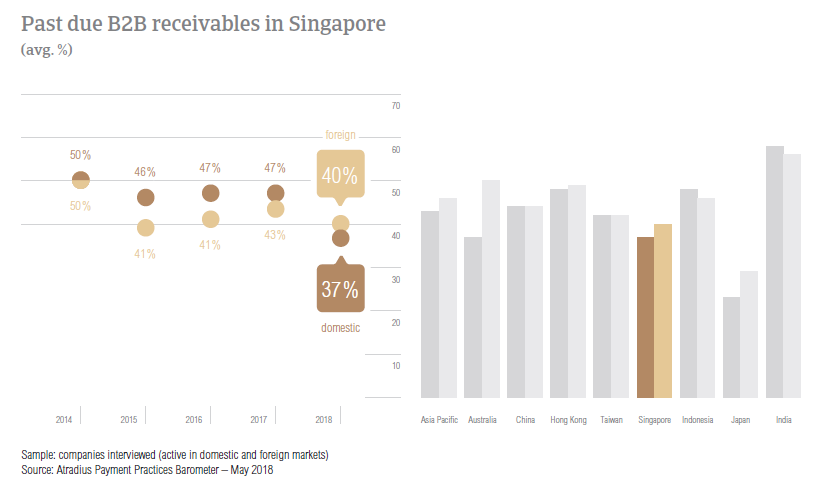

Arrears fall for third year in a row

Meanwhile, the average frequency of arrears dropped to 91.1% from 93.6% in 2017, marking the third consecutive year with a decrease. Still, Singapore remains one of the countries where the vast majority of respondents reported being impacted by payment delays.

The number of invoices paid late also dropped from 44.9% in 2017 to 38.4% and is one of the lowest percentages of overdue B2B invoices in Asia Pacific.

In 2017, respondents in Singapore gave their B2B customers significantly shorter payment terms than in 2016 (on average, 25 days to domestic B2B customers and 24 days to foreign B2B customers). In 2018, however, payment terms have increased again; domestic B2B customers are asked to settle their invoices, on average, within 27 days and foreign B2B customers within 28 days.

However, payment delays in Singapore have decreased significantly in 2018. A 10-day decrease was reported in regards to domestic B2B customers (who delayed payments, on average 14 days) and a four-day decrease in respect to B2B customers abroad (on average, 16 days).

In Singapore, the government has made e-invoicing mandatory for their suppliers since May 2018. However, Atradius found that 24.9% are not invoicing their B2B customers electronically. The majority of respondents (54.2%) are already making use of e-invoicing and 19% said that they intend to start doing so in 2018.

Asked about the effect of e-invoicing on payment duration, the majority (57.8%) believe that after invoicing electronically, they received payments quicker. In contrast, 7.4% said that they have experienced a slowdown and 34.9% that there was no noteworthy effect on payment duration.

When asked if they expect turnover changes based on trade uncertainty and global protectionist measures, 37.9% of respondents in Singapore said that they do not expect to be impacted over the coming 12 months.

“Of those who expect a change for the worse, 26.9% foresee a negative effect of up to 10%. A lower but notable percentage (19.8%) expect losses between 10% and 20%. Only 3% of respondents said that they expect that the developments due to protectionist measures around the globe will have a positive effect on their businesses,” Atradius added.

Similarly to what was observed in 2017, construction and consumer durables sectors generated some of the longest payment delays and paid on average 24 and 19 days after the due date, respectively. The sectors cited insufficient availability of funds and the buyer using outstanding invoices as a form of financing.

Advertise

Advertise