REITs buck earnings downturn in Q2

The sector was supported by acquisitions and lower interest rates.

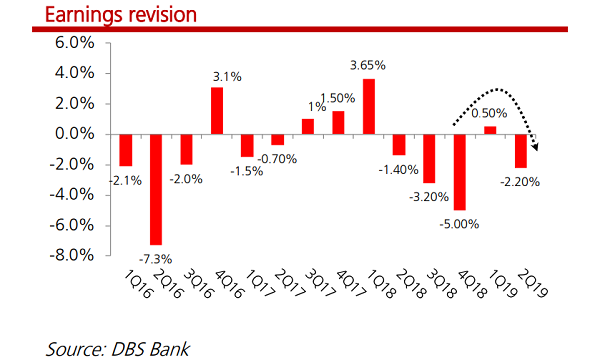

The earnings of major stocks covered by DBS Group Research reversed the 0.1% growth in Q1 after falling 2.2% in Q2 2019 largely due to the downturn across sectors except for REITs, a note revealed.

A lack of order wins, specifically by Sembcorp Marine, affected oil & gas (O&G) stocks whilst a weak crude palm oil (CPO) price outlook dragged down the consumer goods sector, said DBS Group Research analyst Kee Yan Yeo.

Moreover, the consumer services sector was affected by start-up losses for BreadTalk, rising cost and lower margins for Dairy Farm, and Jumbo’s one-off renovation disruption.

The technology sector, comprising Hi-P International and Venture Corporation, suffered “poor visibility” due to the US-China trade war whilst SingTel’s decline in associates’ profit contribution dragged on the telco sector.

REITs brought some cheer coming from acquisitions and lower interest rates. Notably, Manulife US REIT's net property income (NPI) rose 33.8% YoY to $37.74m in Q2, largely thanks to contributions from its acquisitions Centerpointe and Penn and Phipps.

Also read: Manulife US REIT NPI up 30.8% to $72.46m in Q2

Yeo noted that earnings could be further cut in 2020 if the US-China trade war drags further. “Defensive names with good visibility remain in favour. Singapore market continues to offer good yields from banks, telco, REITs, and technology players at nearly 5% or more,” he said.

Advertise

Advertise