Chart of the day: Asset quality of top three SG banks to remain steady

Fitch peer reviewed DBS, OCBC, and UOB in a new report.

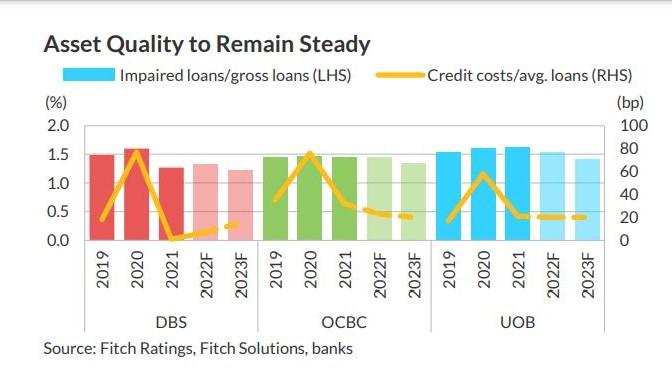

This chart from Fitch peer-reviewed the asset quality of the DBS, OCBC, and UOB.

Fitch expects asset quality to remain steady, as the banks’ non-performing loan (NPL) ratios were stable in the range between 1.3% to 1.6% at end of the first quarter of 2022, even as almost all of their loan portfolios have exited relief programmes related to the pandemic.

READ MORE: Chart of the day: Remote job postings in Singapore fall by 25% in May

The banks have exposure to Russia and Ukraine however, Fitch said that these have insignificant effects on their portfolios.

“Additionally, we believe it is improbable that the consolidation of Citigroup’s assets will cause DBS’s and UOB’s NPL ratios to rise significantly as to weigh on the asset-quality score, given the small size ofthe acquired loans relative to their existing books,” Fitch said.

Advertise

Advertise