Chart of the Day: Banks prefer customer deposits to current and savings accounts

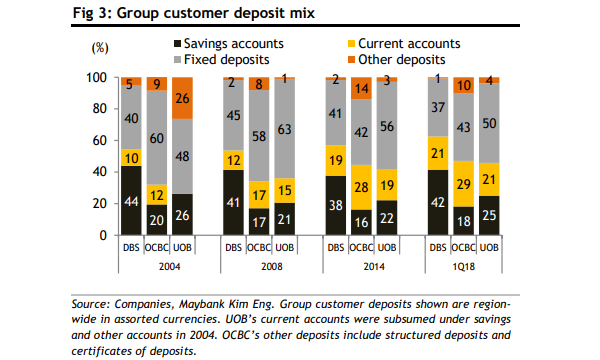

Deposits to current and savings accounts jumped 9-13 ppts over 10 years.

This chart from Maybank Kim Eng shows that deposits to the current and savings accounts (CASA) in Singapore's three banks has risen by 9-13ppts since 2008. The mix of CASA deposits rose across all three banks: DBS from 54% to 63%, OCBC from 34% to 47% and UOB from 36% to 46%.

This is despite SGD fixed-deposit (FD) rates have risen 10-25bps since April. OCBC and UOB raised their promotional rates whilst DBS raised its 9-12-month rates by 25-35bps.

"[The banks] continue to prefer CASA deposits as these are typically sticky," said Maybank KE analyst Ng Li Hiang.

Ng noted that local banks continue to pay for current deposits as they bundle or cross-sell them with other products such as credit cards (see UOB One, OCBC 360, DBS Multiplier).

"SGD loan-to-deposit ratio is the highest for UOB, at 95% vs peers’ 86-88% and the system’s 86%, based on our estimation. With higher loan demand, banks are likely to price more aggressively to compete for deposits," he added.

Advertise

Advertise