Chart of the Day: Singapore defends banks from bad SME loans as defaults spike

Defaults will be shared by the government.

Escalating economic woes have pushed more small and medium enterprises (SMEs) in Singapore to default on their loans in 2015, causing top lenders to be more cautious in extending funds to smaller firms.

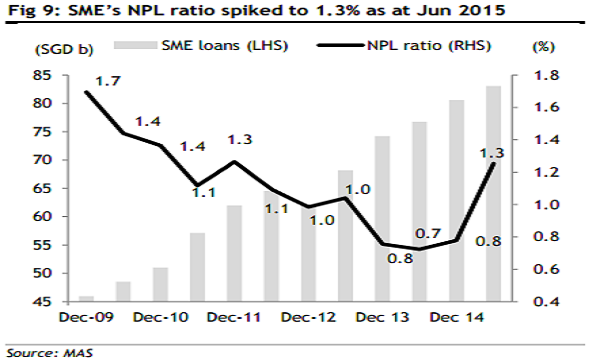

This chart from Maybank Kim Eng shows that the non-performing loan ratio for SME loans hitting a record high of 1.3% in the first half of 2015, a level not seen since December 2011.

As smaller enterprises grapple with squeezed credit lines, the government has finally stepped in to give SMEs easier access to corporate credit. In Budget 2016, the government introduced the SME Working Capital Loan Scheme, which will allow banks to co-share default risk of SME loans with the government.

“We see this as a win for SMEs and for Singapore banks. With these measures for the government to co-share default and to improve local SMEs’ access to loans, it may help alleviate some concerns on the Singapore banks’ exposure to this segment,” said Maybank Kim Eng.

Advertise

Advertise