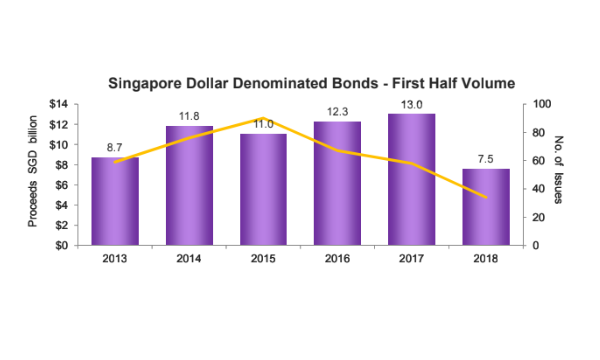

SGD bond markets down 41.9% to $7.5b YTD

LTA’s $1.2b bond offering is 2018’s largest so far.

The total Singapore-dollar bond issuance declined 41.9% YoY to $7.5b (US$5.7b) so far this year, Thomson Reuters revealed.

Data revealed that the SGD bond market crashed by 63.9% QoQ to $2b (US$1.5b) during the second quarter of 2018 the as the number of primary issuances fell 30%.

Government & Agencies accounted for 41.4% of the market share, raising $3.1b in proceeds, up 122.5% from the first half of 2017.

Land Transport Authority’s $1.2b bond offering is the biggest SGD bond so far this year. State-owned Housing and Development Board (HDB) continued to tap the local bond market with three primary offerings worth a cumulative total of $1.6b (US$1.2b) in proceeds. In June, Temasek Holdings’ unit, through Astrea IV, priced its asset-backed securities worth $677.25m (US$501m).

The Financials sector accounted for 27.5% of the SGD bond market and totalled $2.1b (US$1.6b) so far this year. Real Estate followed behind with 22.3% market share.

Advertise

Advertise