Hotel demand to continue outstripping room stock in 2019

Visitors who cannot find rooms are forced to turn to alternative accommodation providers.

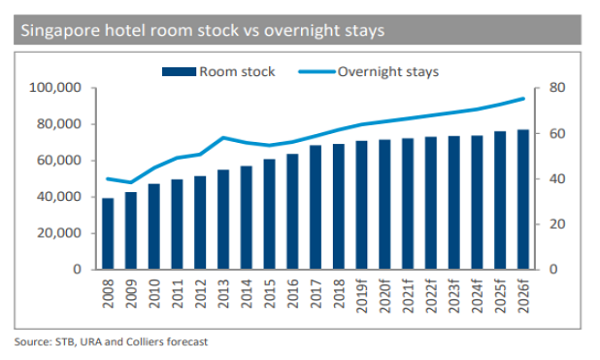

Singapore’s hotel supply growth is expected to remain muted in the short term and fall short of demand, with an estimated total of 70,929 rooms in 2019, amidst a projected 3.5% growth in tourism arrivals, a report by Colliers International revealed.

In 2019, visitor arrivals are expected to reach 19.2 million, with a further 3% growth forecast for 2020. “This is a robust performance after the stagnant figures in 2015, and strong growth in 2016, and is mostly underpinned by an increase in visitation from North and South Asia, and in particular China, Indonesia and India,” Govinda Singh, executive director for valuation and advisory at Colliers International Asia, said in the report.

Also read: Changi Airport saw 5.58 million passengers in April

In terms of hotel performance, Colliers International noted that room occupancy remained well in excess of 83% despite the new supply. That said, a closer look at the room stock versus demand suggested that hotels in Singapore are full almost all the time during peak periods, and especially during Monday to Thursday, and Saturday nights.

“This suggests that there is a high degree of existing frustrated and latent demand, whereby visitors who wish to come to Singapore either cannot find rooms or have to turn to alternative accommodation providers,” Singh explained.

In 2012, given that 65% of overnight visitors would stay in a hotel, the total number of available rooms at that time gave an implied room occupancy of 134%, according to the firm’s analysis. From the hotel statistics provided by the Singapore Tourism Board (STB), which indicated that room occupancies for 2012 were 87%, this suggests only an approximate 64.9% of those requiring accommodation were able to do so in a hotel.

Fast forward to 2018, when hotel room occupancies dipped slightly to 86% for the year, only 46% of the 55% requiring rooms would have been accommodated, Singh said. “We note that the implied room occupancy for 2017 would have dropped to 107%, given the increase in new supply. This remained rather stagnant in 2018,” he added.

According to Singh, it may be high time for Singapore to reconsider more development and investment in the hospitality sector.

Also read: Will Singapore hotels' four-year slump end in 2019?

In 2018, occupancy grew to 86%, with average daily rate (ADR) edging up 1.7%, which resulted in a revenue per available room (RevPAR) growth of 3.5% to $188.6. “This was mainly underpinned by the substantially low supply of new hotels entering the market against a backdrop of surging visitor arrivals. Hoteliers were therefore able to maximise their yield strategy through higher room rates,” Singh added.

With the recent tender of the government land site at Club Street, the white sites at Pasir Ris Central and Marina View, which Colliers estimated could together potentially accommodate around 930 rooms, an additional 2,500 rooms are forecasted to be added between 2022 and 2025.

Significant new hotels scheduled to open beyond 2021 include the Pullman Singapore with 342 rooms, Banyan Tree Mandai comprising 400 rooms, and Club Street with 390 rooms.

Colliers further noted that given the government’s announcement of the hike in development charges, coupled with already high land costs, any new hotel development projects may be put off in favour of refocusing capital on existing projects, or those properties that can be easily converted to hotel use within the existing plot ratio.

In April, Marina Bay Sands (MBS) and Genting Singapore announced that they had committed an estimated $9b in non-gaming investments that would see the two integrated resorts expanding to add 2,100 rooms, on top of additional leisure and entertainment attractions.

A report by DBS Equity Research also noted that UOL, which has control over a prime integrated development comprising a retail mall and three hotels fronting the Marina Bay area, might be in for some opportunity as a hotel operator with the redevelopment of Marina Square, with the potential change of operator at Marina Mandarin which could see UOL going head-to-head against Pan Pacific.

Advertise

Advertise