Singapore unemployment rate dropped to 2.9% in 2018

Residents made up 66% of the retrenchments in 2018, slightly lower than their share of employment at 67%.

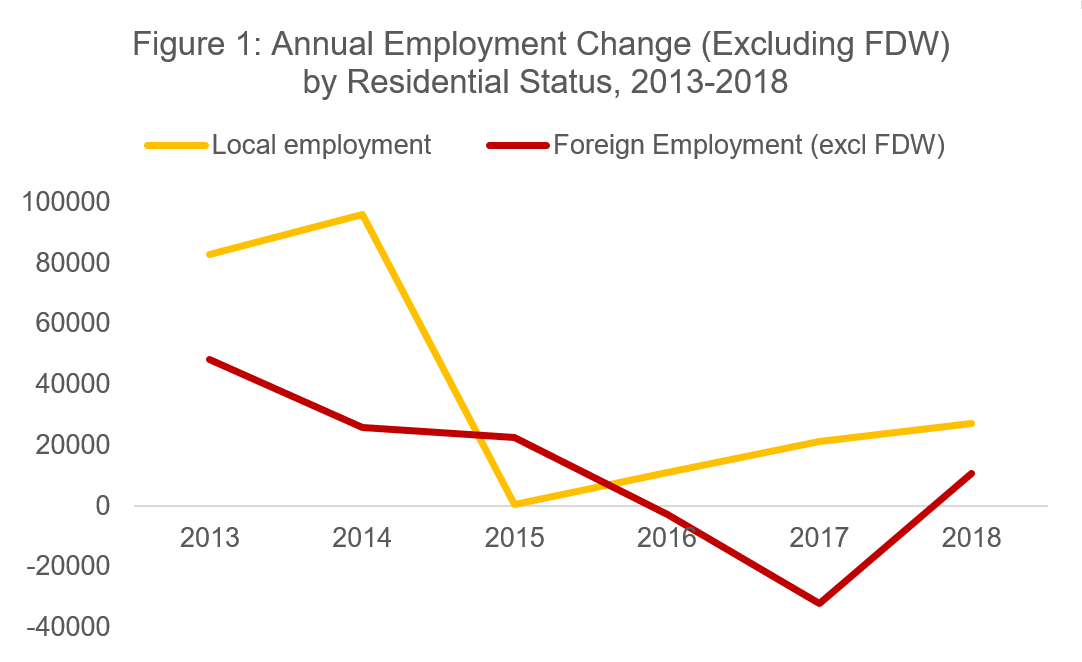

The number of workers in Singapore excluding Foreign Domestic Workers (FDW) grew by 38,300 in 2018, a reversal from the decline in 2017, data from the Ministry of Manpower (MOM) revealed.

Local employment growth in 2018 (+27,400) was also higher than a year before (+21,300). Growth occurred mainly in Community, Social & Personal Services, Transportation & Storage, Financial Services, Information & Communications, and Professional Services.

Likewise, foreign employment (excluding FDW) grew by 10,900 in 2018, reversing the decline in 2017 (-32,000). MOM cited the stronger growth in the Services sector (+16,600 in 2018 compared to +10,700 in 2017), and the moderating decline in the Construction sector (-5,400 in 2018 compared to -32,800 in 2017).

S Pass holders grew by 11,100, across all sectors, led by the Services sector and with the highest growth seen in Administrative & Support Services, Food Services, Information & Communications, Professional Services, and Transportation & Storage.

Meanwhile, Employment Pass (EP) holders continue to decline across sectors in 2018, as a result of the raising of the EP qualifying salary in January 2017. Over the last two years, the number of EP holders has declined by 6,400.

The annual average resident unemployment rate fell to 2.9% in 2018, lower than the rate in 2017 (3.1%). The improvement was broad-based across most age and education groups, MOM said.

Similarly, the annual average resident long-term unemployment rate (LTUR) fell to 0.7% in 2018, lower than 0.8% in 2017. However, residents aged 30-39, 50 & over, or with secondary-level qualifications saw a higher LTUR than the year before.

Retrenchments declined to 10,730 in 2018, significantly lower than the year before (14,720). “The decrease was seen across the three broad sectors, Manufacturing, Construction and Services. This mainly reflected the fall in retrenchments attributed by retrenching companies to poor business or downturn in the industry, as the economy continued to expand in 2018,” MOM commented.

Residents made up 66% of the retrenchments in 2018, slightly lower than their share of employment (67%).

The six-month re-entry rate into employment of retrenched residents was 64.2% in Q4 2018, higher than a year before (63.2%). In particular, those aged below 30 (83.5%), 30 – 39 (75.7%), or Clerical, Sales & Service Workers (71.5%) had the highest rates of re-entry.

MOM data also showed that the seasonally-adjusted job vacancies to unemployed persons ratio rose to 1.10 in December 2018, higher than a year ago (0.94), reflecting further tightness in the labour market.

Higher incomes

The real median income (including employer CPF contributions) of full-time employed Singaporeans increased by 3.6% p.a. from 2013 to 2018, significantly higher than the 1.7% p.a. in the previous five years. Over the last five years from 2013 to 2018, real income at the 20th percentile grew faster (4.3% p.a.) than at the median (3.6% p.a.).

Meanwhile, the growth of labour productivity slowed down to 3.7% from 4.9% in 2017. The growth of the real value-added productivity per worker also slowed down to 2.5% from 4.1%.

“Overall productivity growth in 2018 was supported by gains in sectors such as Manufacturing and Financial & Insurance Services. On the other hand, productivity growth was weak in the Other Services Industries and Transportation & Storage sectors,” MOM said.

Sectoral performance

Employment in the manufacturing sector continued to weaken and declined by 2,400 in 2018, albeit at a slower pace compared to 2017 (-10,900). “The decline was due to a decrease in Work Permit Holders (WPH) in the Marine Shipyard segment, as it continued to be weighed down by weakness in the rig-building activities, although the pace of decline moderated compared to 2017,” MOM said.

“The expected moderation in the global demand for semiconductors and semiconductor equipment is likely to weigh on output and hence employment in the Electronics and Precision Engineering segments. Nonetheless, the anticipated modest improvement in the demand for oilfield & gasfield equipment and ship repair work will provide support to the Marine Shipyard segment,” MOM said.

Construction employment shrank by 7,100 in 2018, no thanks to a moderation in the decline in Work Permit Holders, which came amidst an easing in the pace of contraction in construction activity.

MOM expects a turnaround in construction output after three consecutive years of decline. “The pickup in contracts awarded since the second half of 2017 is expected to translate into an increase in construction activities in the quarters ahead. With the anticipated improvement in both public and private sector construction works, employment in the Construction sector is expected to rebound,” it added.

The services sector’s total employment (excluding FDW) grew by 47,800 in 2018, higher than in 2017 (39,000). Employment growth was broad-based, with growth driven by the Community, Social & Personal Services, Transportation & Storage, Financial & Insurance Services, Information & Communications, and Professional Services sub-sectors. The employment gains more than offset declines seen in the Accommodation and Retail Trade sub-sectors.

According to MOM, employment growth in outward-oriented Services sectors such as Financial & Insurance Services and Wholesale Trade is expected to ease with the moderation in external demand from key advanced and regional economies. “At the same time, employment growth in domestically-oriented Services sectors is expected to remain resilient. Specifically, sub-sectors such as Community, Social & Personal Services, particularly the Education, Health & Social Services segments, should continue to see a positive hiring trend,” it added.

MOM expects that in 2019, local workforce growth will remain modest due to the underlying demographics of an ageing population. “The labour market is expected to remain tight, with job opportunities available in sectors such as Information & Communications, Financial & Insurance Services, Healthcare, Professional Services, Wholesale Trade and the Built Environment,” it said.

“Reducing the Dependency Ratio Ceiling (DRC) and S Pass sub-DRC in the Services sector from next year will help to keep the labour market tight to sustain the impetus for restructuring and support good employment outcomes for Singaporeans,” the ministry added.

Advertise

Advertise