In Focus

Auction listings surged 35% to 1,088 in 2018

Auction listings surged 35% to 1,088 in 2018

It was spurred by the increase in residential and industrial listings, as well as mortgagee sales put up by banks.

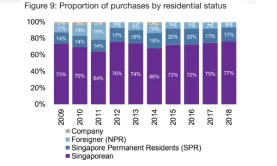

Condo purchases by foreign buyers crashed 20.9% to 1,212 units in 2018

Mainland Chinese transacted 4 in 10 condo purchases.

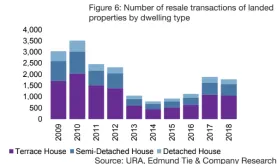

Landed home sales fell 5.8% to 1,780 in 2018

310 homes were sold in District 19.

Cash is still king in Singapore as reluctant elders shun mobile apps

Security concerns in using mobile banking apps rose from 34% in 2017 to 41% in 2018.

Could an airport REIT finance Singapore's massive infrastructure ambitions?

Monetising the first three terminals could command market capitalisation near $10b.

17% of the world's ultra-rich want new homes in Singapore

This is despite the 9.1% price growth in the city’s luxury properties.

Hyflux woes see no end as PUB warns takeover of Tuaspring plant

Tuaspring struggled to keep the plant ‘reliably operational’ to deliver the required desalinated water.

Singapore PMI down 0.3 point to 50.4 in February

It hit the sixth month of decline due to slower growth in new orders, exports, and factory output.

Are retail rents bottoming out?

Rents fell 1% in 2018, marking a slowdown from the 4.7% and 8.3% declines for 2017 and 2016.

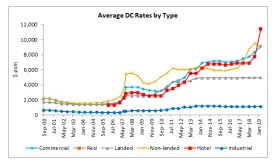

Singapore revamps development charge rates

The rates for commercial and hotel/hospital properties rose 45.6% on average.

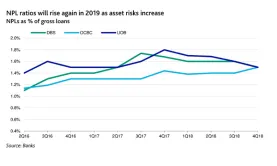

Bad loans haunt Singapore banks as asset quality risks mount

The non-performing loan formation of OCBC and UOB rose by 137bp and 94bp respectively in Q4.

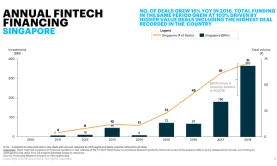

Singapore fintech investments rose two-fold to US$365m in 2018

US$102.2m of the total funds raised went to lending fintech companies such as the homegrown Funding Societies.

Grade A CBD office rents inched up 9.5% in 2018

Marina Bay saw the largest rental increase at 17.1%.

60 projects to boost home sales in 2019

Overall sales could hit 19,000-22,000 units.

Cash and cheques still account for 40% of Singapore payments

Hawker centres, food courts and wet markets remain heavily dependent on cash.

CapitaLand profits jumped 12.3% to $1.76b in 2018

It gained higher contributions from its retail, commercial, and lodging businesses in Singapore and China.

Everything you need to know about the Big 4's reactions to Budget 2019

Find out what EY, Deloitte, KPMG, and PwC have to say about the Budget.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform