Are retail rents bottoming out?

Rents fell 1% in 2018, marking a slowdown from the 4.7% and 8.3% declines for 2017 and 2016.

Retail rents in Singapore fell by just 1% in 2018, marking a slowdown from the rates of decline in 2017 and 2016 at 4.7% and 8.3%, respectively, Colliers International revealed. “This could signal the bottoming of the long-running decline starting in Q1 2015,” said Colliers International’s director and head of research in Singapore, Tricia Song.

According to Colliers data, Orchard Road ground-floor rents moved up 1.4% YoY to $41.20 psf per month during H2 2018, whilst Regional Centres saw a marginal uptick of 0.4% YoY to $33.60 psf per month. This marked some recovery in ground-floor rents.

“We expect ground-floor rents to lead the gradual recovery, but overall retail rents should continue flattening out in 2019-2020 before picking up sustainably on more favourable supply-demand dynamics,” Song said.

Meanwhile, island-wide retail vacancy increased for a second consecutive quarter in Q4 2018 as more retail stock was progressively completed. Retail vacancy increased by 0.9ppt QoQ to 8.5% as of end-December 2018.

On a YoY basis, vacancy increased by 1.1 ppt since the end of December 2017. “The increase in rents even as vacancy goes up could mark the end of the supply overhang in the next few quarters,” Song added.

During H2 2018, the largest new supply injection came from Jewel Changi Airport with a planned Net Lettable Area (NLA) of 576,000 sqft (53,500 sqm). Coupled with the 200,000 sqft (18,500 sqm) redevelopment of Century Square in Tampines Central in Q2 2018 and various smaller islandwide additions, 2018 saw a net 1.0 million sqft (94,000 sqm) of net new completions.

“We advise landlords to be flexible and practical about setting rents in order to support occupancy in the quarters ahead,” Song commented.

Colliers International also observed that tenant profile mixes were heading towards more big-format activity-based retail concepts such as game arcades, billiard rooms and gyms taking up anchor tenancies in malls.

Online retailers also went offline or to physical marketplaces to enhance their offerings. Taobao opened its first physical store in Singapore in Nomadx at Plaza Singapura. Love, Bonito set up its second fashion outlet after success with its first flagship in end-2017. Online grocer honestbee opened habitat, billed as “the world’s first tech-enabled grocery and dining concept”.

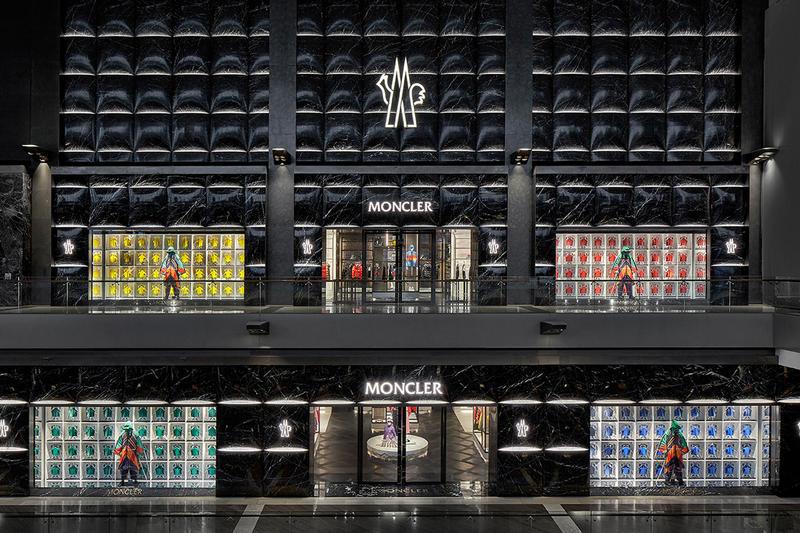

Global luxury brands also continue to embrace the concept of duplexes or dual-level shops, and expansion into children’s wear, Song noted. Marina Bay Sands Shoppes now host 17 duplexes - the largest collection of duplexes under one roof in Singapore. In January 2019, Italian apparel manufacturer and lifestyle brand Moncler opened a flagship duplex at The Shoppes, its largest store in the Asia-Pacific region.

Photo from Hypebeast: https://hypebeast.com/2019/1/moncler-singapore-marina-bay-sands-inside-look

Advertise

Advertise