Singapore revamps development charge rates

The rates for commercial and hotel/hospital properties rose 45.6% on average.

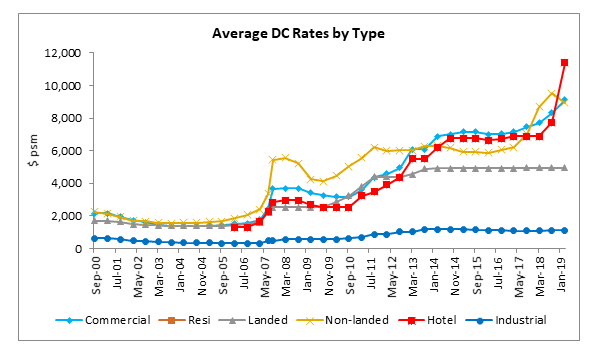

The Ministry of National Development revised the development charge (DC) rates for the period 1 March 2019 to 31 August 2019. The DC rates for two use groups, Groups A (Commercial) and C (Hotel/Hospital) have increased on average by 9.8% and 45.6% respectively, whilst the DC rates for Use Group B2 — Residential, non-landed have decreased by 5.5%.

Commercial

The DC rates for Use Group A (Commercial) have increased by 9.8% on average. According to Colliers International, this the highest rate of growth since March 2014 when it grew 14.6%.

116 out of the 118 sectors have increases in DC rates ranging from 3% to 17%. There is no change to the DC rates for the remaining 2 sectors.

The largest increase of 17.4% was seen in eight sectors covering areas that include Outram Road, Chinatown, New Bridge Road, Selegie Road, Victoria Street, Jalan Besar, Geylang Road amongst others.

“We believe the increase in the commercial use DC rates in these areas are mainly due to the bullish valuations in the shophouse segments in these locations, as well as the rising office and stabilising retail markets in general,” said Tricia Song, head of research for Singapore, Colliers International.

Desmond Sim, head of research, Singapore & Southeast Asia, CBRE, concurred and noted that sectors 15, 16 and 21 also all registered 16.7% increases.

Residential, non-landed

The DC rates for Use Group B2 or Residential, non-landed have decreased by 5.5% on average, the first decline in DC rates for this Use Group since September 2016. 94 out of 118 sectors have reduction in DC rates ranging from 4% to 13%. Rates are unchanged for the remaining 24 sectors.

“On the back of a muted collective sale market and the lower-than-expected land bids arising from Kampong Java and Dairy Farm Road sites, subdued land price expectations followed,” Sim commented. The executive noted that both sectors 91 and 94 saw downward DC revisions of 13.3% each, whilst sectors 93 and 104 saw corrections of 13.0% each.

“There has been a lack of residential land transactions since July 2018. The largest declines in non-landed residential DC rates, appear to be in city fringe areas with large potential future supply such as East Coast and Hougang,” Song added.

“Whilst these identified sectors do not correspond directly with the two GLS sites that had lower-than-expectation bids, it should be noted that these sectors are part of the new areas identified by the ‘Revision to Guidelines for Maximum Allowable Dwelling in Non-Landed Residential Developments Outside the Central Area’ that took effect from 17 January 2019,” Sim said.

Hotel/hospital

The DC rates for Use Group C (Hotel/hospital) have increased by 45.6% on average. According to Colliers, this is the highest rate of increase on record. This is also the second consecutive hike in DC rates for this Use Group, following the 11.8% average increase announced in the previous revision on 31 August 2018, Song added.

116 out of the 118 sectors have increases in DC rates ranging from 7% to 74%. Sectors 25, 26, 28, 29, 30, 32, 33 and 34 saw an increase of 73.9% each in the DC rates.

There is no change to the DC rates for the remaining 2 sectors. “The sharper upward revision was expected, in view of the rosier outlook for the hospitality sector, amid stronger tourism performance,” Song commented.

According to Song, the number of hotel deals have picked up in recent months, with some bullish transaction prices such as the collective sales of Waterloo Apartments and Golden Wall Centre (both to be converted to hotel use), the government land sale of Club Street hotel site, and the private sale of Ascott Raffles Place serviced apartments.

Sim noted that Golden Wall Centre, which was transacted in November 2018 for $2,331 psf per GFA, was announced that it is likely to be converted for Hotel use. “Similarly, Waterloo Apartments has the same intention of change of use to Hotel. It is located in sector 27, which also saw an increase of 66.7%,” he added.

“The recent GLS site for Hotels that was sited along Club Street, saw a healthy bidding of 8 bidders, of which the winning bid was 12.4% above the runner up. This site is located in sector 16 which saw an increase of 52.8%,” the executive commented.

“These transactions could have contributed to the broad-based and significant increase in DC rates in hotels,” Song added.

According to the Urban Redevelopment Authority (URA), if there is any disagreement over the DC payable for any development proposal calculated based on the rates under the respective Use Groups, developers and owners can opt for a case-by-case valuation by the Chief Valuer, as provided for in the Planning Act.

Advertise

Advertise