News

SGX-backed ADDX designates new CEO

SGX-backed ADDX designates new CEO

The new CEO projects ADDX total transactions will reach $1.36b by 2023.

DBS establishes Board Sustainability Committee

It will be chaired by CEO Piyush Gupta and will consist of DBS board members.

Retail is rising, here’s why

Sales finally grew by 11.8% in January after three years of decline.

Chart of the day: Top 3 soft and hard skills employers are looking for

The skills applied to both permanent and temporary employees.

Market update: STI down 0.85%

Wilmar International was seen with the most growth.

Financial institutions on the lookout for risks arising from Russia

Local FIs are reportedly taking appropriate measures to manage risks, says MAS.

Retail sales drop 2.5% MoM in January

Twelve of 14 industries also posted a decline in their respective sales.

VTL program sets sights on Greece and Vietnam

Applications for these countries are set to open on 13 March.

Almost half of millennials prioritise savings for vacations H1

This is as Singapore opened more vaccinated travel lanes.

F&B sales up 9.5% YoY in January to $829m

Online sales made up 29.1% of the total sales for the month.

Karim family acquires House of Tan Yeok Nee

The house was the sole survivor of the 19th century Four Houses.

Jardine Matheson’s underlying profit jumps 39% to $2.06b

Given this, the company proposed a final dividend of $2.24 per share.

Dairy Farm's underlying profit drops 62% to $142.7m

This is due to the impact of the reduction in the contribution from Yonghui.

Grab loses its grip with $1.1b loss for Q4

Around $3.6b total loss was recorded for FY2021.

4 of 10 Singaporeans eye travel in the next 3 months

A mix of domestic and international plans make up their plans.

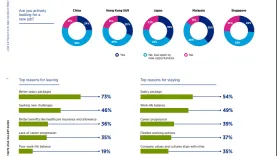

Chart of the Day: 1 in 2 SG employees actively looking for new job opportunities

Better salary packages and new challenges were cited as the main reasons for doing so.

Market update: STI up 0.47%

Wilmar International was seen with the most growth.

Advertise

Advertise

Commentary

Why Singapore businesses must focus on outvaluing, not just upskilling

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform