Photo by Sabrianna on Unsplash

Photo by Sabrianna on Unsplash

Anti-proliferation financing law mandates post-closure record-keeping for pawnbrokers, PSMDs

Failure to comply may result in a fine of up to $100,000 (US$74,000).

Pawnbrokers, moneylenders, and dealers in precious products must now retain records of their transactions for five years even after ceasing operations, following Singapore’s move to strengthen its measures against proliferation financing.

For precious stones and metals dealers (PSMDs), failure to comply with the record-keeping requirement may result in a fine of up to $100,000 (US$74,000).

Record-keeping, however, is only one of the new requirements imposed under the Prevention of Proliferation Financing and Other Matters Bill (PPFOM), which the Parliament passed in February.

Pawnbrokers and moneylenders, for example, will face stricter scrutiny in their applications to the Registrar for licences and employment of assistants under the bill, as the prevention of money laundering, financing of terrorism, and proliferation financing are now additional grounds for refusal, according to Gary Low, co-head for Criminal Law Practice at Drew & Napier LLC.

The measure also requires pawnbrokers to enhance customer due diligence, implement programmes and measures, document risk assessments, implement internal policies, and have an independent audit function related to terrorism financing and the proliferation of weapons of mass destruction.

Low said pawnbrokers who fail to comply with these requirements may face conviction under the law and be fined up to $100,000.

Several measures grant the Minister the authority to establish rules to prevent money laundering, terrorism financing, and the proliferation of weapons of mass destruction.

Violating these rules can result in fines of up to $20,000 (US$14,800), imprisonment for up to 12 months, or both for pawnbrokers, and penalties not exceeding $100,000 for moneylenders.

Compliance costs

The requirements mandated by the bill, according to Low, may result in increased compliance costs, disproportionately affecting small businesses.

Low, however, underscored that these additional costs are not expected to be significant as requirements mandated by the bill are similar to the “measures that the affected industries already have in place to counter money laundering and terrorism financing.”

Pathik Shah, founder of AML Singapore, shared a similar sentiment, saying the measure will not put up “any significant additional compliance cost.”

“These measures do not add to the compliance or risk mitigation responsibilities of moneylenders, pawnbrokers, or legal professionals, as these businesses have already adopted them under the existing anti-money laundering and combating terrorism financing laws,” Shah told Singapore Business Review.

“Considering the amended provisions, the regulated entities will have to be cautious of identifying the proliferation financial risks, along with ML/FT and continue applying adequate risk mitigation measures to combat the proliferation financing risks, similar to what is presently applied for managing the ML and FT risks,” he added.

Even with increased compliance costs, both experts believe that the measure will have a positive effect on the regulated entities.

“The amendments brought about by the PPFOM Bill provide moneylenders, pawnbrokers, and legal firms with greater clarity as to the exact scope of their roles and responsibilities in respect of preventing proliferation financing, including the concrete steps that need to be taken to ensure compliance,” Low said.

“Businesses will also benefit by being able to differentiate themselves in the market by demonstrating a strong commitment to preventing money laundering and the financing of terrorism, thereby enhancing their reputation through building trust with its customers, partners, and regulators” he added.

In the second reading of the PPFOM Bill, Nominated Member of Parliament (NMP) Neil Parekh Nimil Rajnikant said the measure offers an opportunity for businesses to engage in more robust international collaboration and may lead to better global practices and potentially open new markets and partnerships that value such stringent compliance standards.

Shah’s insights are no different, saying the bill empowers the affected entities to safeguard the economy against proliferation financing.

“The measures to identify and manage the PF risk would prevent the criminals involved in the proliferation of weapons of mass destruction from raising, moving and using funds for illegitimate purposes,” Shah said.

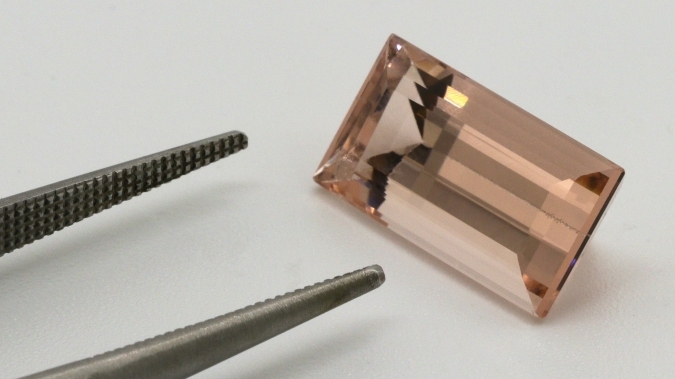

Low added that the measure also aligns Singapore with the requirements introduced by the Financial Action Task Force (FATF) in October 2020, as the bill clarifies the definition of “precious products: to include any item priced above a specified threshold of $20,000.”

Before the PPFOM Bill, precious stones and metals excluded products whose value is largely due to other factors like branding or workmanship.

“The existing definition only covers products where at least 50% of the value is attributable to the precious stone or metal,” Low said.

Singapore, being a member of the FATF, must update its regulatory framework to ensure that the sectors of PSMDs, moneylending, pawnbroking, and legal services adhere to the revised FATF standards on countering proliferation financing.

With the prescribed value set at $20,000, Singapore is now in line with FATF standards and international best practices, said Low.

Concluding, Shah said the bill will “enhance the Singapore entity’s compliance status in the international market.”

Advertise

Advertise