Chart of the Day: How exposed are Singapore banks to property loans?

They're not just limited to mortgages.

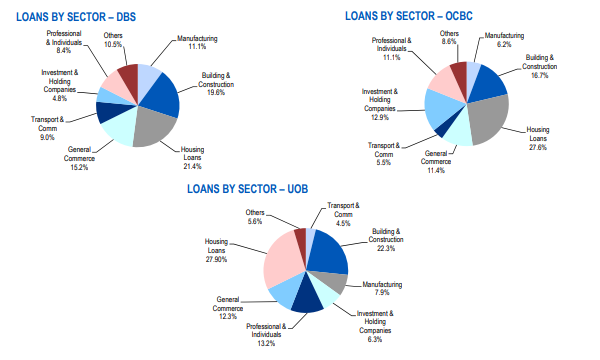

This chart from UOB Kay Hian shows how Singapore's top three banks are exposed to the property sector, which has hit by an announcement of cooling measures two weeks ago. Analysts noted that loan growth has been driven by new launches in the market due to rejuvenation, but with new measures, it could slow down.

DBS and UOB have more exposure to building & construction at 19.6% and 22.3% of total loans respectively. OCBC and UOB have more exposure to residential mortgages at 27.6% and 27.9% of total loans respectively.

Also read: Chart of the Day: Housing loans comprise largest portion of banks' lending

Meanwhile, about 21.4% of DBS' loans are housing loans, whilst OCBC loans are 16.7% in the building & construction sector.

Overall, UOB has the largest exposure at 50.2% on an aggregate basis, followed by OCBC at 44.3%. Traditionally, delinquency for residential mortgages is extremely low and current NPL ratio is just 0.4%, UOBKH noted.

Advertise

Advertise