Private condo prices hit record highs

The average price of non-landed homes reached a new high of $1,427 psf in January to February 2018.

According to OrangeTee Research, private condo prices have surpassed their peaks in the first two months of 2018. “Based on our analysis of caveats lodged with URA as at 01 March 2018, the average price of non-landed homes reached a new high of $1,427 psf in January to February 2018,” it said. This is 1.7% higher than the previous peak of $1,403 psf in 2017.

OrangeTee noted that for new sales, the average price of non-landed homes rose 7.9% to a new record of $1,629 psf. Sub-sales surged 10% to $1,410 psf below its 2013 peak of $1,450 psf. Prices of resale homes held steady at $1,314 psf, marginally below the peak of $1,318 psf in 2017.

Also read: 10 most profitable executive condos after privatisation

OrangeTee Research and Consultancy head Christine Sun said, “The soaring prices across the different segments may indicate that prices have bottomed out and almost the entire real estate sector is set to roar along in top gear this year.”

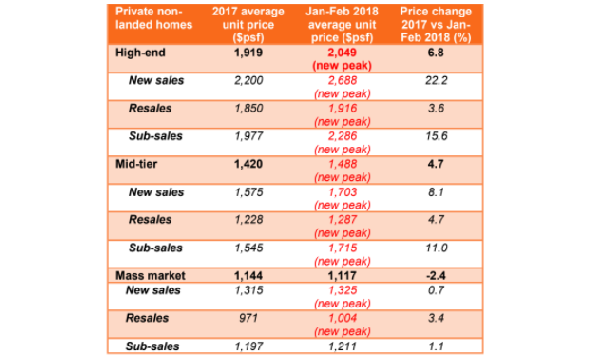

Record prices were seen in the high-end, mid-tier and mass market segments. “Prices of luxury homes continued its climb this year. The average price rose 6.8% from $1,919 psf in 2017 to $2,049 in Jan-Feb 18. New sales rose 22.2% to a new high at $2,688 psf over the same period. Sub-sales were up 15.6% to $2,286 psf while resales increased 3.6% to $1,916 psf, both of which are record highs,” OrangeTee added.

This year, 17% (76 units) of the 451 luxury home caveats were bought for over $5m. Of these, 11 were transacted above $10m. Comparatively, about 50 transactions priced above $10mwere completed in 2017.

The firm noted that the most expensive homes were two units of The Nassim transacted at $19.6m (7,061 sq ft) and $17m (6,598 sq ft). A 2,174 sqft unit at Le Nouvel Ardmore was transacted at $4,098 psf, the highest per sq foot recorded this year.

The price increase for the mid-tier homes was more moderate at 4.7%, rising from $1,420 psf in 2017 to $1,488 psf in Jan-Feb 18. New sales, resales and sub-sales were similarly at record highs of $1,703 psf, $1,287 psf and $1,715 psf respectively.

Prices of mass market homes dipped marginally by 2.4% to $1,117 psf in January to February 2018. Compared to 2017, prices of new sales rose marginally by 0.7% to $1,325 psf and resales by 3.4% to $1,004 psf, both being record highs. Sub-sales rose by 1.1% to $1,211 psf.

Compared to 10 years ago, mid-tier homes rose the fastest by about 70% ($882 psf), followed by the mass market segment (66%, $672 psf) and the luxury segment (33%, $1,543 psf).

“Whilst prices have escalated in recent months, a housing bubble is unlikely to form in the near future. Factors that fuelled the property bubbles in 2007 and 2010 are notably absent – high volume of sub-sales (an indicator of speculative activity), many overstretched borrowers and an influx of foreign buyers,” Sun added.

Advertise

Advertise