Chart of the Day: Singapore doubles its weight on the Global Dividend Yield Index

With 26 SGX-listed stocks in the index, Singapore is represented more than India, Indonesia, and Thailand.

Singapore stocks account for 0.84% of the FTSE All-World High Dividend Yield Index which is composed of stocks that pay out higher than average dividend yield, accordng to a note from SGX Research.

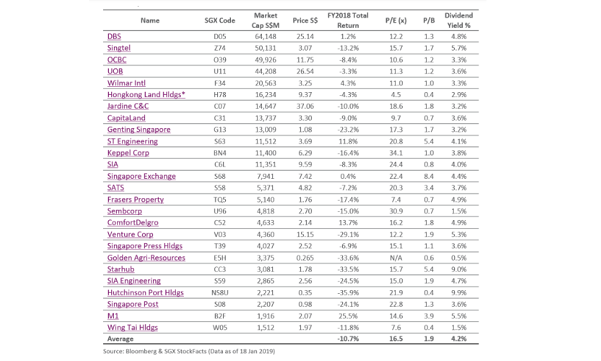

"Amongst the list of global constituents, there are 26 SGX-listed stocks that generated a mixed performances in 2018, with an average marginal decline of -10.7%. They maintained an average indicative dividend yield of 4.5%," the research firm said.

Of the 26 high-paying Singapore stocks that made it to the global list which includes the secondary listing of Hongkong Land Holdings, the five best-performing stocks in 2018 include M1, ComfortDelGro, ST Engineering, Wilmar and DBS which averaged an 11.3% gain over the year.

Also read: Dividends of Temasek-funded firms could jump 38.8% to $9.3b in 2018

"This means Singapore contributes more stocks to the FTSE All-World High Dividend Yield Index than India, Indonesia, Philippines and Thailand," the firm noted.

In fact, the weighting of Singapore stocks in the FTSE All-World High Dividend Yield Index is double the 0.42% weight that Singapore stocks maintain the FTSE All-World Index. There are currently a total of 1,389 stocks that make up the FTSE All-World High Dividend Yield Index and 3,197 stocks that make up the base index - the FTSE All-World Index.

A report from IHS Markit forecasts Singapore stocks to shell out $19.87b in total dividends for 2019 which represents a 2.8% decrease amidst the absence of one-off special dividends from DBS and Keppel.

“The big three banks in Singapore continue to be the largest dividend contributor and are projected to pay $7.13b in 2019,” IHS Markit said in a December report. “Whilst total dividends from this sector are set to fall in 2019 owing to the absence of the one-off specials paid by DBS earlier this year, fundamentals remain robust and consensus earnings estimates reflect an upbeat look for the banks."

Advertise

Advertise