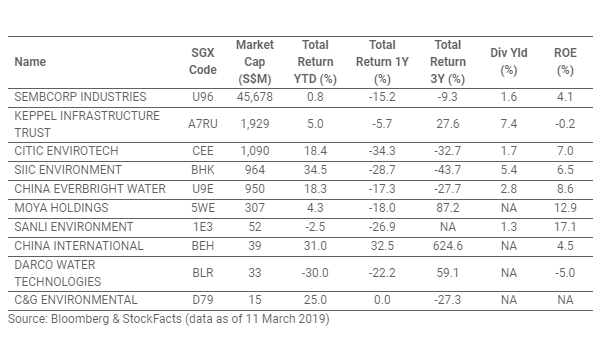

Chart of the Day: Top 10 water infrastructure plays hit average returns of 25% in March

SIIC Environment saw the highest return of 34.5% in March YTD.

This chart from the Singapore Exchange (SGX) shows that the top 10 water infrastructure stocks saw average returns of 25% YTD in March.

The three largest capitalised and best-performing water stocks were SIIC Environment (34.5% YTD), CITIC Envirotech (18.4% YTD), and China Everbright Water (18.3% YTD). The trio averaged a total return of 23.8% YTD, closing their one-year and three-year total returns to -26.8% and -34.7%, respectively whilst their average dividend yield hit 3.3%.

SGX noted that the big three water stocks focus on China’s water sector, and specialise in environmental water services that include building and managing water and wastewater treatment plants, water supply and recycling, seawater desalination, sludge treatment, as well as development of other water technologies.

“With nearly 20% of the world’s population and only about 6% of global freshwater resources, China’s water sector is a high priority for the country’s policy makers. With the government’s push towards environmental protection, demand for wastewater treatment facilities has increased across all sectors,” the local bourse noted.

Advertise

Advertise