GST hike

Delaying GST hike will ‘store up more problems' for Singapore: DPM Wong

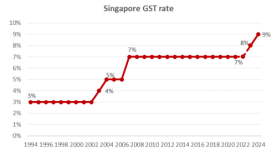

GST will increase to 9% on 1 January 2024.

Delaying GST hike will ‘store up more problems' for Singapore: DPM Wong

GST will increase to 9% on 1 January 2024.

Around 2.9 million Singaporeans may get up to $200 cash payout

The government raised the Assurance Package by $1.4b.

Tourists, foreign residents accounted for about 50% of GST revenue in 2018 and 2019: Wong

The net annual GST during the period was around $5.7b.

Will the GST rate hike exacerbate Singapore inflation?

The headline and core inflation climbed to multi-year highs in May 2022.

Gov’t to push through with GST increase despite rising inflation

The GST will be increased from 7% to 8% on 1 January 2023, and to 9% on 1 January 2024.

Why GST hike should push through despite rising goods prices

The country’s social expenditures are also going up exponentially, say experts.

Raising GST for fiscal sustainability

Singapore’s Goods and Services Tax (GST) rate will be raised from the current 7% to 8% on 1 January 2023 and again from 8% to 9% on 1 January 2024, as announced by the Finance Minister in his Budget 2022 speech.

Gov’t to collect additional 0.7% of GDP per year with GST rate hike

GST will be increased to 8% in 2023 and 9% in 2024.

What do the Big Four have to say about the Singapore Budget 2022?

Businesses were urged to plan ahead as GST rate hike gets delayed.

Chart of the Day: Rate of Singapore GST hike over the years

The hike implementation originally scheduled in 2022 was moved to 2023.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?