Billion-dollar office deals buoy property investments in Q2

The biggest deal was AEW’s $1b purchase of Chevron House.

Investment sales volume in Singapore’s office sector surged in Q2 2019 anchored by big ticket deals such as AEW’s purchase of Chevron House from Oxley Holdings for $1b, which is said to be the biggest deal of the quarter, a report by Cushman & Wakefield revealed.

The second largest deal saw South Korea’s National Pension Service acquiring a 50% stake in Frasers Tower for $982.5m, which came after Frasers Commercial Trust (FCOT) exercised its right of first refusal as the deal would not be yield accretive for its unitholders. There was also a suburban office activity, with Metro Holdings and Evia Real Estate buying 7 & 9 Tampines Grande for $395m.

Also read: CBD Grade A supply hit 25.1 million sqft in Q1

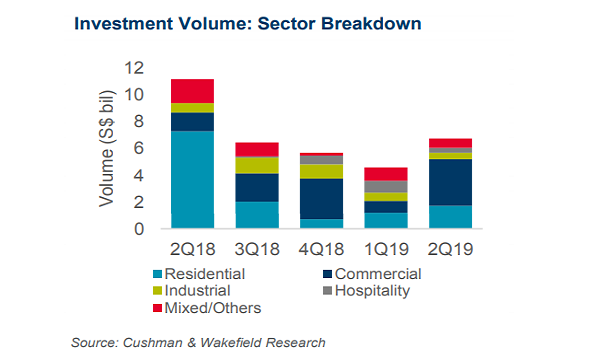

Commercial deals hit $3.5b in sales, making up 52% of the total real estate investment sales volume of $6.7b in Q2 2019.

At $6.7b, total investment sales increased 49% from the previous quarter, bringing the total H1 2019 volume to $11.2b at the mid-point of 2019, Cushman & Wakefield noted. In comparison, the residential sector clocked $1.7b and the industrial sector $500m.

“Prices are riding on the expectation that yield-hungry investors will be diverted from the bond market to the commercial property market due to the widening yield spread. The momentum seen in the commercial sector during H1 2019 is expected to continue with the sale of more big ticket items in the pipeline, such as DUO Tower, 71 Robinson Road, and Anson House,” Christine Li, Cushman & Wakefield’s head of research for Singapore and Southeast Asia explained.

With assets in the Central Business District (CBD) highly sought after, investors may increasingly look more closely at the decentralised office market for opportunities similar to 7 & 9 Tampines Grande, Li added.

The report also noted that Arch Capital Management is undertaking due diligence for the purchase of Anson House at around $210m, whilst Gaw Capital Partners and Allianz Real Estate are in advanced negotiations to acquire DUO Tower and DUO Galleria for approximately $1.6b.

Also read: URA Draft Master Plan to boost mixed-use properties in CBD

“The URA 2019 Draft Master Plan’s recommendation to rejuvenate the CBD certainly created some buzz in the commercial investment market, and the introduction of the CBD Incentive Scheme has attracted the attention of commercial landlords who are interested in redeveloping their properties,” Shaun Poh, head of capital markets at Cushman & Wakefield, said. “This has led to some owners of adjacent smaller plots contemplating the possibility of joining forces to qualify for the scheme. New investors could also be brought into these partnerships or consortiums to provide additional funding.”

Meanwhile, Singapore’s retail sector was also active during the quarter, with Mitsubishi Estate and CLSA acquiring Chinatown Point Mall for $250m. Also, Frasers Centrepoint Trust purchased a one-third stake in Waterway Point from its sponsor Frasers Property for $440.6m.

In the industrial sector, CapitaLand divested 11 StorHub warehouses for $166.4m, whilst ESR-REIT bought a 49% stake in Poh Tiong Choon Logistics Hub for $110.3m.

Cushman & Wakefield is projecting the full-year 2019 investment volume to come in at around $25b.

Advertise

Advertise