Industrial occupancy rate edges up in Q3, new space falls to record low

Only 24,000 sqm of new space was completed during the quarter.

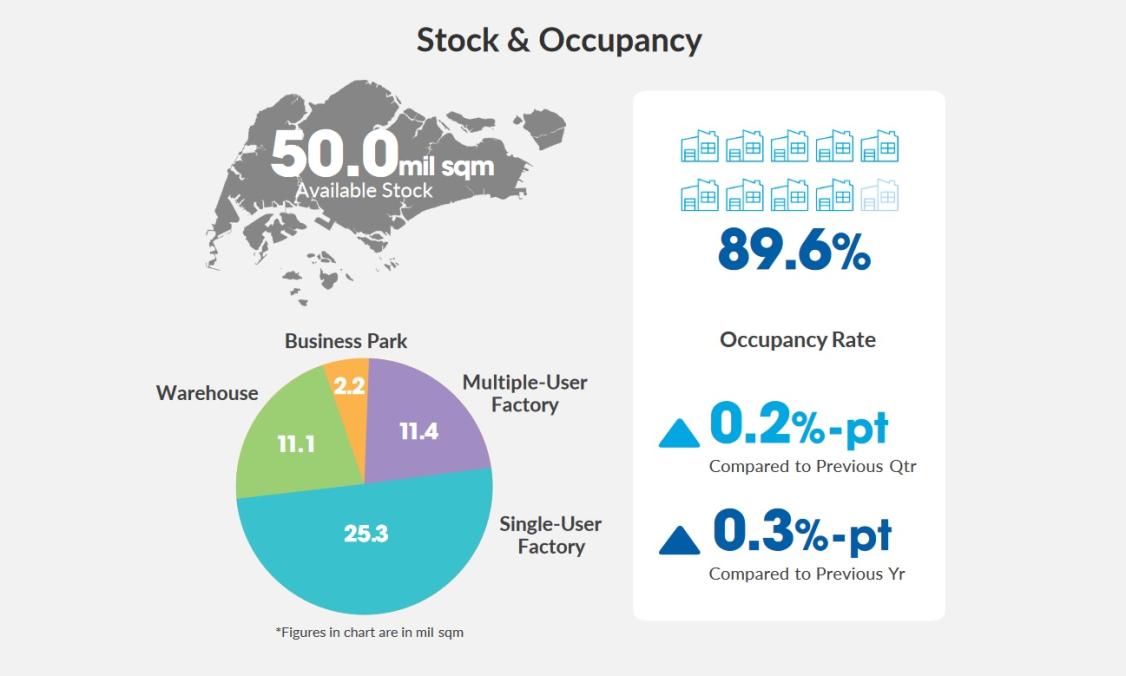

Occupancy rate for the overall industrial property market rose 0.2 percentage points (ppt) by the end of Q3 compared to the previous quarter as demand for storage rose amidst delay in new completions, according to the latest quarterly report released by JTC.

Compared to Q3 2019, occupancy rate is 0.3 ppt higher.

Only 24,000 square meter (sqm) of new industrial spaces was completed in Q3, the lowest on record. This is significantly lower than the average quarterly completion of 270,000 sqm recorded in the last three years.

Available space is expected to remain tight in the coming quarter with only 0.6 million sqm of new industrial space projected to be completed in Q4. This is a sharp reduction from the 1.3 million sqm of new space originally expected to be completed in the second half of 2020, JTC said.

Completion of around 0.7 million sqm of space has been delayed to 2021 and even 2022 as a result of the pandemic’s impact on the construction sector.

JTC says to expect further delays in the completion of some industrial projects, as project owners and contractors adjust to meet safe restart requirements.

Meanwhile, although the occupancy rate rose, prices and rentals saw larger declines in Q3 compared to Q2, noted JTC. The price index of all industrial space dropped by 2.2% QoQ whilst the rental index slipped by 0.9% QoQ in the period of comparison.

Compared to a year ago, the price index declined 3.9% whilst the rental index decreased by 1.6%.

By segment, occupancy rates of multiple-user factory space, warehouse space, and business park space all rose by 0.3%, 0.8%, and 0.2% in Q3 compared to the previous quarter.

In contrast, the occupancy rate of single-user factory space dipped 0.1% QoQ over the same period.

As of end-Q3 there is approximately 50 million sqm of industrial space in Singapore.

Advertise

Advertise