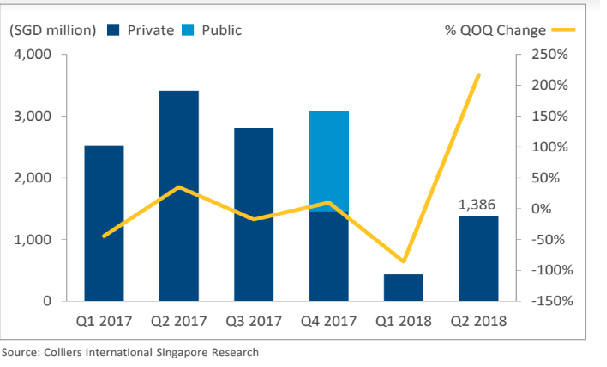

Chart of the Day: Commercial property sales ballooned 216.8% to $1.4b in Q2

The biggest transaction for the Q2 is the divestment of Twenty Anson for $516m.

This chart from Colliers International Singapore Research showed that the commercial sector turned around in Q2 with investment sales rising to 216.8% to $1.4b from a slump in Q1.

However, it also revealed that commercial investment sales volume dropped 59.3% YoY compared to the peak of sales in Q2 2017.

The Q2 recovery was mainly powered by the purchase of the Twenty Anson from CapitaLand Commercial Trust for $516m by US-based property investment manager AEW.

Other transactions considered to have a significant impact to the quarter's pickup include the divestment of Sembawang Shopping Centre for $248m, MYP Plaza for $247m, and The Rail Mall for $63.24m.

Advertise

Advertise