Frasers Tower sale could boost Frasers Property's EPS by $0.17-$0.20

The potential disposal could push ROE towards 10%.

Frasers Property can cash in on the potential billion-dollar sale of Frasers Tower as the divestment could boost its net asset value (NAV) and earnings per share (EPS) by $0.17-$0.20, according to a report by DBS Equity Research.

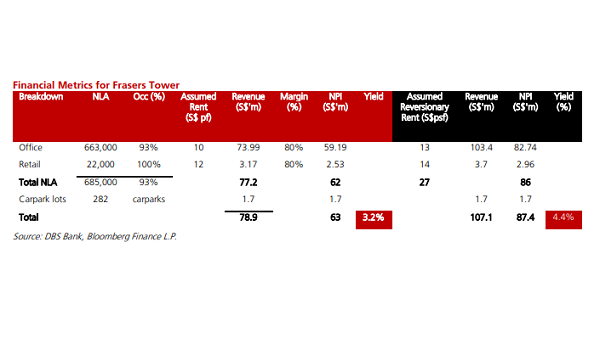

Frasers Property said in an exchange filing that it is in talks with interested parties on the potential sale of newly completed 38-storey Grade A office tower on Cecil Street for a reported price of $2.05b or approximately $3,000 psf for the 685,000-sqft net lettable area (NLA) development.

“This will represent a neat 36-47% return on capital invested,” DBS analyst Derek Tan noted. “Based on our estimates, Frasers Property has invested an estimated $1.3-1.4b since winning the site through a government land sale (GLS) back in 2013. We believe that the value of the proposed ongoing recycling of assets will be realised over time, and narrow the gap between its RNAV and NAV.”

Being a one-off occurrence, the sale is also expected to drive return on equity (ROE) towards 10%, which could be a re-rating catalyst for the stock.

Meanwhile, the analysts also noted that Frasers Commercial Trust (FCT) could be in the running to buy the property although the $2b price tag may be too large for FCT to stomach in one go.

“If FCT does decide to acquire, the key is to win sufficient support from investors and its sponsor that the deal will likely be marginally accretive or dilutive to FCT which is trading at a fairly high cost of equity of 6.5%,” Tan said, adding that FCT may instead look to taking a partial stake in Frasers Tower in an aim to gradually build up its assets under management (AUM) and market cap.

Advertise

Advertise