OCBC Bank

OCBC Bank is the longest established Singapore bank, formed in 1932 from the merger of three local banks, the oldest of which was founded in 1912.

See below for the Latest OCBC Bank News, Analysis, Profit Results, Share Price Information, and Commentary.

Banks offer flexiwork, mentor programmes to uplift women’s careers

This International Women’s Day, we spoke with Singapore’s big three banks on how they are helping close the gender gap in their workforces.

Banks offer flexiwork, mentor programmes to uplift women’s careers

This International Women’s Day, we spoke with Singapore’s big three banks on how they are helping close the gender gap in their workforces.

Daily Markets Briefing: STI up 0.29%, DBS takes the lead

The top stocks are DBS, Sembcorp Marine, and UOB.

Major banks posted NIM expansion and strong growth in Q4 22

These banks delivered higher than expected dividends.

OCBC reports record net profit of S$5.75b in 2022

Full-year dividend is at 68 cents per share, 28% higher than in 2021.

OCBC CEO Helen Wong appointed as executive director

She will now assume responsibility for both roles.

Singapore banks to report flattish Q4 22 earnings amidst slow global growth

NIMs will rise but the expansion could decelerate due to higher funding costs.

AI, big data amongst trends in banks: Maybank

Investments in AI are at an accelerating pace for DBS, UOB, and OCBC.

Banks in the Lion City have been deploying AI and big data at an accelerating pace, analysts from Maybank said.

Amongst the banks that are investing in these technologies are DBS, OCBC, and UOB.

For instance, DBS allocated $1b annually for the past four years. In fact, the bank sent out 30 million personalised insights to 3.5 million customers.

Another bank investing in such tech is UOB, which sought to spend $500m to scale digital offerings until 2026, on top of the average $535m spent on technology yearly in the past four years.

OCBC also made its technological investments such as the AI lab it already launched in 2019.

“These investments are now reaching commerciality, enabling the banks to leverage customer data and relationship-driven insights,” read the report.

What these advancements are doing is to allow banks to leverage customer data as well as relationship-driven insights.

For example, in retail banking, it is initially translating into serving up personalised product offerings including discounts and targeted deals.

The advanced tech also offers customised insights on customer spending habits and automated assistance on payments and subscriptions are becoming standard offerings on their digital apps.

Analyst sees banking ROE improvement due to NIM expansion

RHB said there will be tailwinds from hikes in federal funds rate.

Perennial Holdings clinches S$3b green loan for 8 Shenton Way redevelopment

It is the world’s largest real estate green loan in Asia to date.

OCBC names Noel DCruz as Group Chief Risk Officer

He has worked for the bank for 33 years.

OCBC Bank, NTU Singapore enter $5m research collaboration

They aim to develop solutions for sustainability, data privacy, and cyber security

Interest rates will be Singapore banks’ boon and bane through 2023: analyst

It’ll benefit them over the next three quarters, but asset quality may deteriorate after.

OCBC net profit up 31% YoY to S$1.6b in Q3 2022

The company’s net interest income grew by 44% YoY.

OCBC appoints Sunny Quek as head of global consumer financial services

He will lead the bank’s banking and wealth business in Singapore.

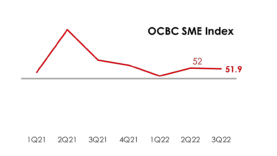

Chart of the day: OCBC SME Index remains expansionary for 7th quarter

Outlook for the fourth quarter remains good despite expectations to moderate downwards

Market update: STI down 0.74%

DBS stocks dipped by 0.88%

More Singaporeans want a greener future but are doing more emissions-heavy activities

Amongst these activities include use of air conditioners, which rose 21% in 2022.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?